Introduction

Understanding the stock market and making accurate predictions is essential for any investor. With the rise of AI and machine learning, stock prediction websites have emerged as powerful tools for investors to make informed decisions. This guide will explore the inner workings, accuracy, and benefits of these platforms, as well as the factors they consider for their predictions.

How Do Stock Prediction Websites Work?

Stock prediction websites use advanced prediction algorithms and machine learning techniques to analyze historical data and current market trends. By leveraging vast amounts of data and sophisticated algorithms, these platforms generate forecasts for various financial instruments. Some websites, such as FinBrain, even offer specialized tools like the FinBrain Terminal and FinBrain API for traders and institutional investors to access AI stock forecasts and alternative data.

Are Stock Prediction Websites Accurate?

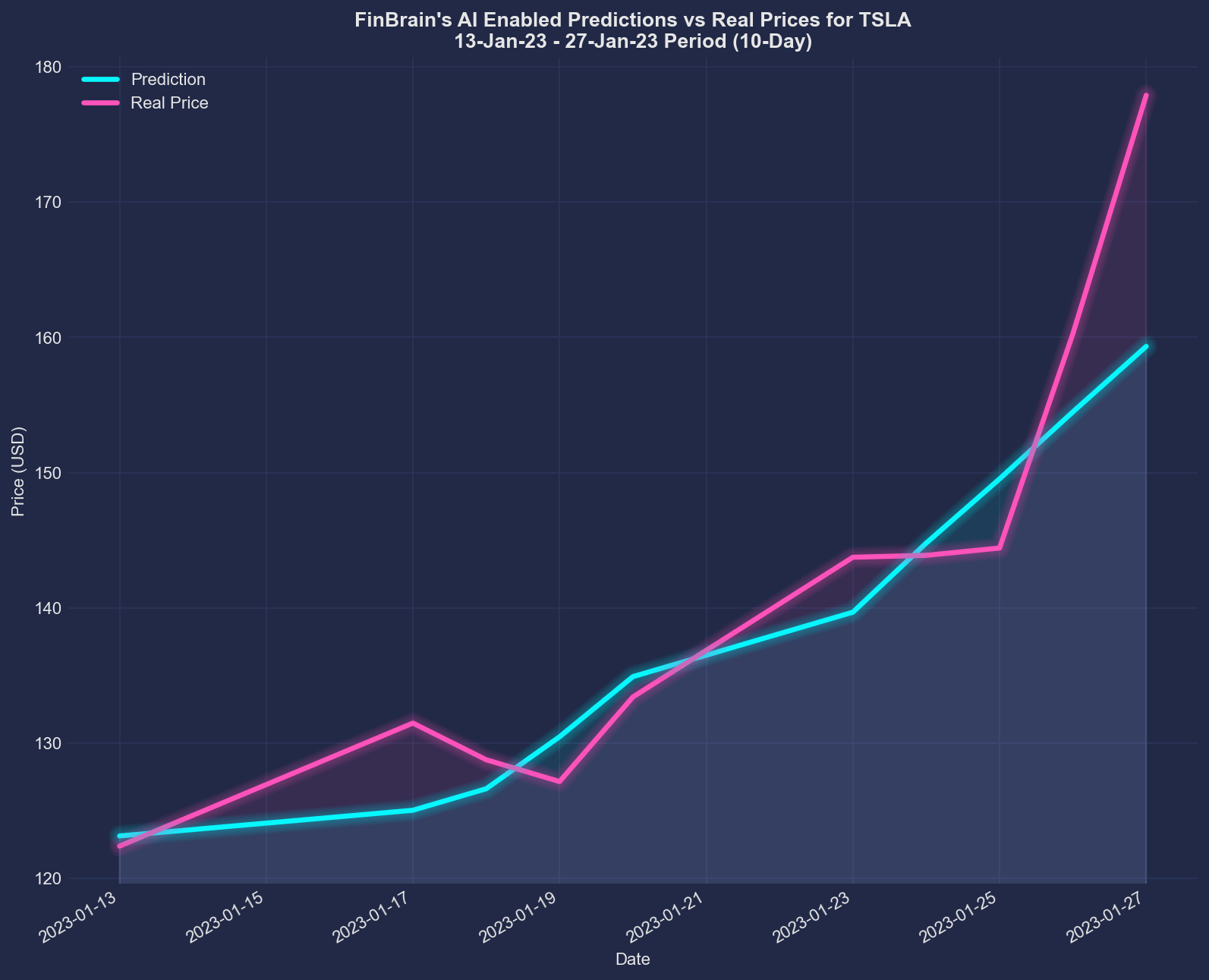

While no stock prediction website can guarantee 100% accuracy, many have shown remarkable success in forecasting stock prices. The accuracy of these platforms depends on the quality of their algorithms, data sources, and methodologies. For instance, FinBrain’s AI-based stock prediction has demonstrated impressive accuracy for TSLA stock, while other examples include accurate forecasts for S&P 500 stocks, AAPL stock prices, and AMZN forecast performance.

Can Stock Prediction Websites Help Me Make Better Investment Decisions?

Yes, stock prediction websites can help you make informed investment decisions by providing valuable insights into market trends and potential price movements. These platforms can help you identify opportunities and risks, allowing you to adjust your investment strategies accordingly. However, it’s essential to remember that these forecasts should be used as a supplementary tool, not a substitute for your research and judgment.

What Factors Do Stock Prediction Websites Consider for Their Predictions?

Stock prediction websites consider various factors for their forecasts, including historical price data, market trends, financial news, economic indicators, and company-specific information. Some platforms even incorporate social media sentiment and alternative data sources, like FinBrain’s Most Mentioned Tickers on WallStreetBets tracker, to enhance their predictions.

Are There Any Free Stock Prediction Websites?

Yes, there are free stock prediction websites available, but the quality and accuracy of their forecasts may vary. Some platforms offer limited access to their tools and data for free, while others require a subscription for full access to their advanced features and insights. It’s essential to research and compare different platforms to find the one that best suits your needs and budget.

FinBrain Technologies: The Premier Stock Prediction Website

FinBrain Technologies stands out as the best stock prediction website in the market, offering a comprehensive suite of AI-based stock forecasts and alternative financial data. With its advanced algorithms and innovative datasets, FinBrain helps individual investors maximize their investment returns through a data-driven approach.

AI Stock Forecasts and Alternative Financial Data

FinBrain provides AI stock forecasts for various stocks, along with a wealth of alternative financial data, including:

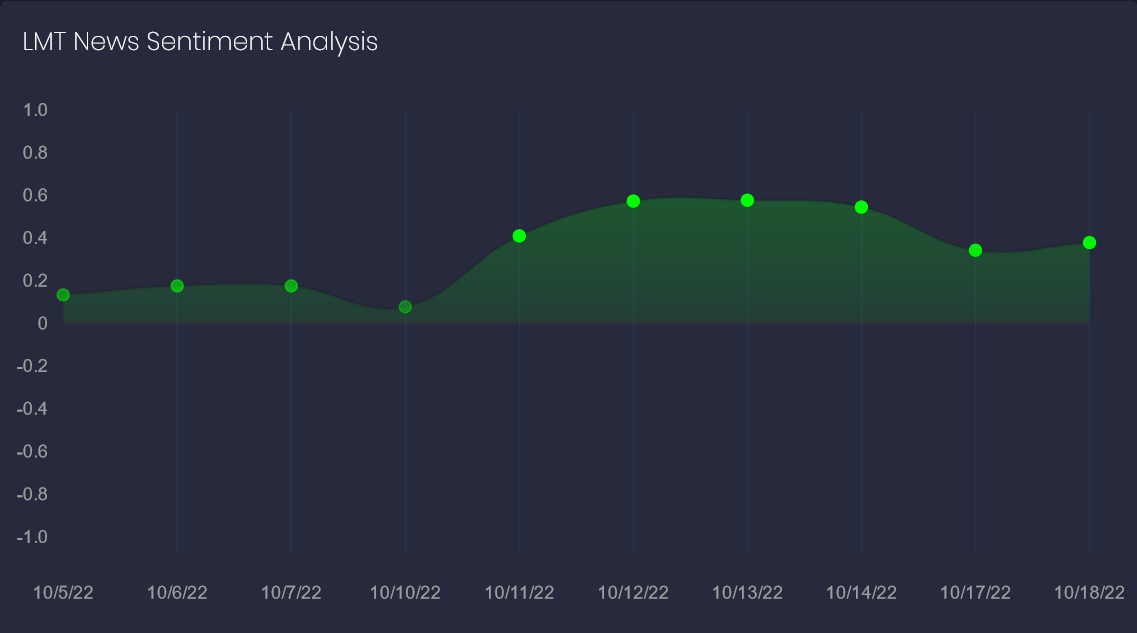

- News Sentiment Analysis

- Mobile App Score Ratings

- US Congress Members’ trades

- Option Put-Call ratios

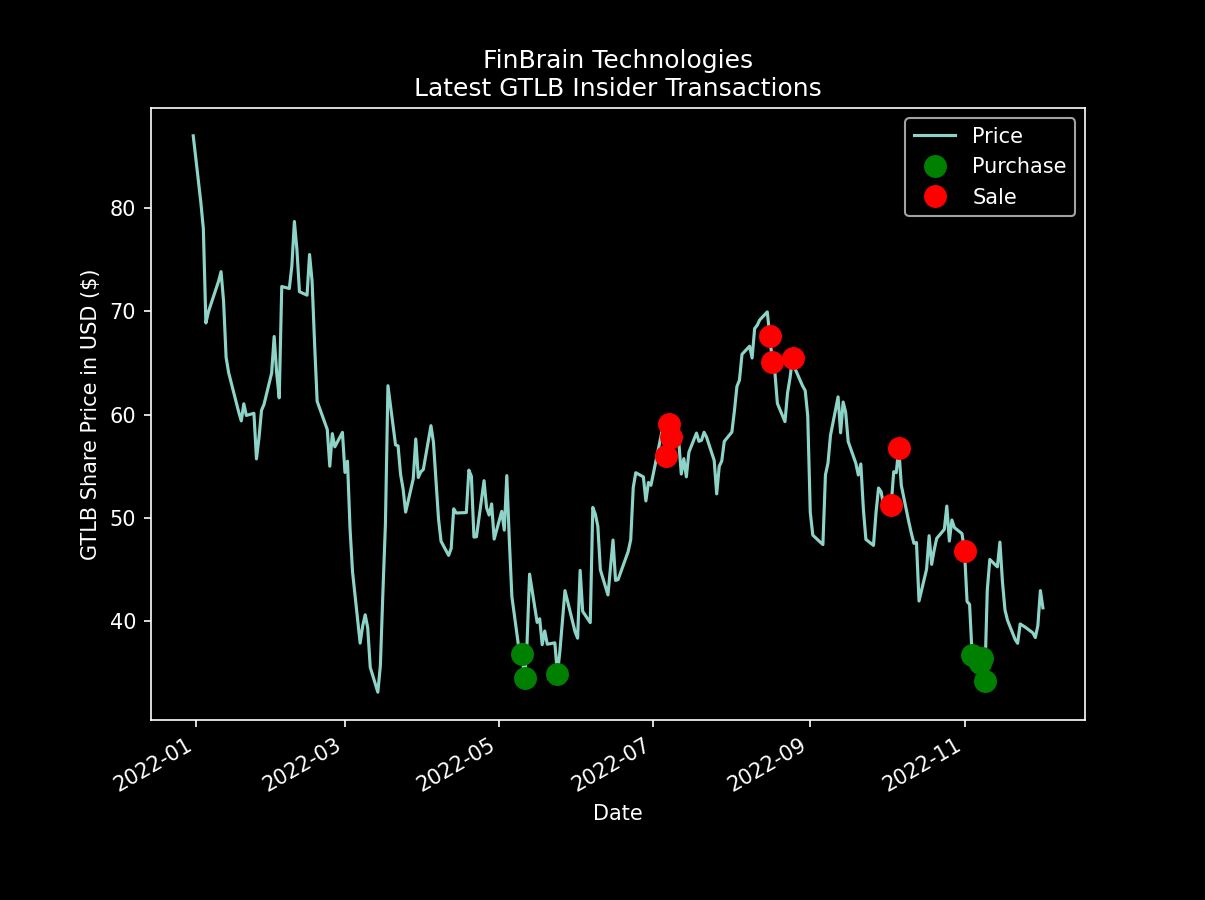

- Company insider transactions

By incorporating these datasets into their investment strategies, investors can significantly increase their chances of achieving higher returns.

How Machine Learning and AI Improve Stock Predictions

Machine learning in stock prediction websites has revolutionized the way investors analyze and predict stock market trends. By leveraging vast amounts of data and continually learning from it, machine learning algorithms can identify complex patterns and relationships that may be difficult for human analysts to detect.

AI-based stock prediction models can process and analyze data from various sources, such as financial news, social media sentiment, and economic indicators, to generate more accurate and timely forecasts. As a result, these algorithms can help investors make better decisions and minimize risks in their investment strategies.

Harnessing AI and Data-Driven Investing for Maximum Returns

Using an AI-assisted and data-driven investing approach allows individual investors to make better-informed decisions. FinBrain’s AI stock forecasts and alternative financial data help investors identify trends, risks, and opportunities that may not be evident through traditional analysis. This advanced approach empowers investors to make more strategic investment decisions and ultimately improve their portfolio performance.

FinBrain’s alternative data has demonstrated remarkable accuracy, as evidenced by the following blog posts:

- How did GitLab Inc. insiders time the bottom and top in the stock price perfectly?

- Was the heavy insider selling activity on Alphabet signaling the decline in its share price?

- Almost perfectly timed Devon Energy stock purchases by a US Congressman

- Spotting the signals of a 9% surge in LMT stock price beforehand

- Can tracking company insider trades make you money in the stock market? Here is the Asana Inc. example

- Catching the early signals of the massive increase in BBBY stock price

By leveraging FinBrain’s accurate alternative data, investors can gain valuable insights and make more informed investment decisions.

In conclusion, FinBrain Technologies offers a unique combination of AI stock forecasts and alternative financial data, making it the premier stock prediction website for investors seeking to maximize their investment returns. With its innovative approach and proven track record, FinBrain is the go-to platform for data-driven investing.

Final Thoughts

In conclusion, stock prediction websites and tools offer valuable insights and forecasts that can help investors make better investment decisions. While no platform can guarantee 100% accuracy, many of these websites have demonstrated impressive results using advanced algorithms and machine learning techniques.

It’s essential to research and compare different platforms, considering factors such as accuracy, ease of use, and cost, to find the best fit for your investment needs. By leveraging the power of AI-based stock prediction and other tools, you can optimize your investment strategies and achieve better returns in the long term.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005

Leave a Reply