Introduction

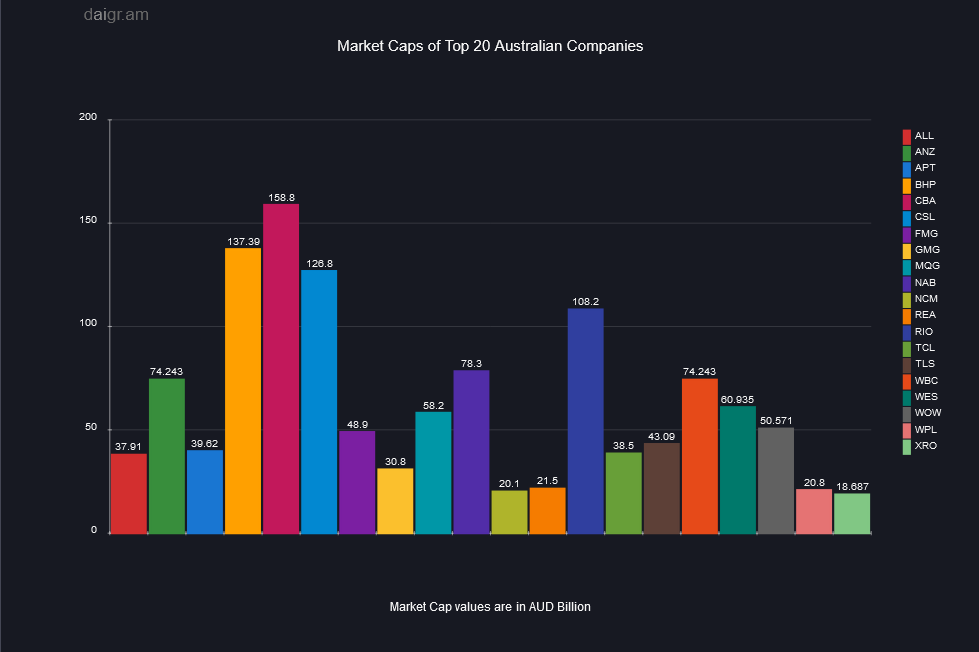

Australia’s stock market, known as the Australian Securities Exchange (ASX), is home to some of the world’s leading companies across various sectors. From banking to mining, technology to retail, the ASX showcases a diverse range of stocks that have not only dominated the domestic market but have also made significant inroads on the global stage. In this article, we will delve deep into the top 20 Australian stocks, exploring their business models, performance, and significance in the broader market landscape.

ALL – Aristocrat Leisure Ltd

Aristocrat Leisure Ltd, a prominent name in the gaming industry, is renowned for its diverse range of products and services. These include electronic gaming machines, casino management systems, and digital social games. The company’s current stock price stands at $41.210. Over the year, Aristocrat’s stock has witnessed a fluctuation, with prices ranging from $30.360 to a 52-week high of $41.850. This indicates a dynamic year-to-date performance in the stock market.

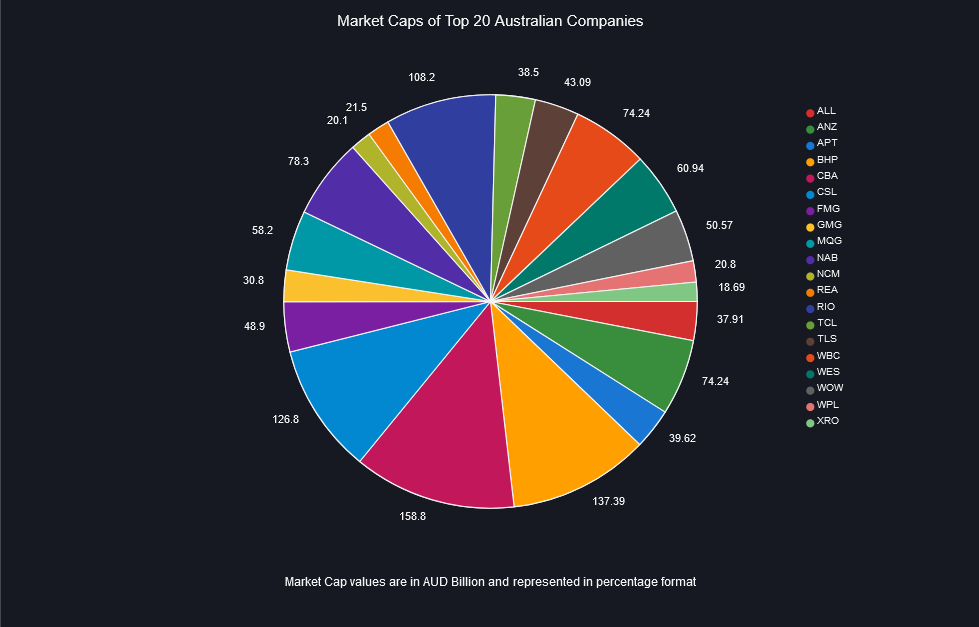

With a significant market capitalization of $27.14 billion, Aristocrat Leisure Ltd holds a strong position in the Consumer Services industry group. Investors often gauge the value of a stock using the P/E ratio, which, for Aristocrat, is 25.49. This ratio provides insights into the company’s earnings relative to its share price, offering a glimpse into its valuation.

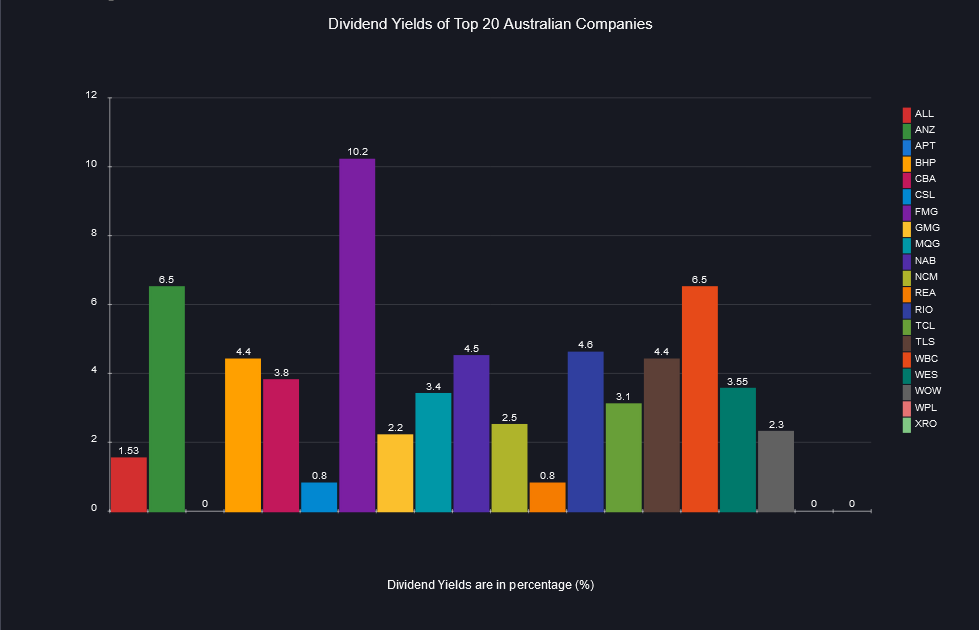

For those interested in dividends, Aristocrat announced a dividend amount of $0.300, translating to a dividend yield of 1.33%. Such dividends are a testament to the company’s commitment to returning value to its shareholders.

The company’s headquarters is strategically located at Building A, Pinnacle Office Park, 85 Epping Road, NORTH RYDE, NSW, AUSTRALIA, 2113. For more detailed information and insights, one can visit the official website of Aristocrat Leisure Ltd.

ANZ – Australia and New Zealand Banking Group Ltd

Australia and New Zealand Banking Group Ltd (ANZ) is one of the major banking entities in the region, offering a comprehensive suite of financial products and services to both individual and business customers. As of the latest data, the bank’s stock price is valued at $25.060, reflecting a slight decrease of $0.139 or 0.555% from its previous position.

The bank boasts a substantial market capitalization of $75.73 billion, placing it firmly among the top financial institutions in Australia. The stock’s performance over the past year has seen it fluctuate between a low of $22.210 and a high of $26.080. Such movements provide investors with insights into the bank’s stability and growth potential in the stock market.

From a financial perspective, ANZ’s P/E ratio stands at 10.90, indicating the price investors are willing to pay for each dollar of the company’s earnings. The bank reported an impressive revenue of $20.71 billion (AUD) and a net profit of $7.11 billion (AUD). Such figures highlight the bank’s profitability and its ability to generate substantial returns.

For dividend-focused investors, ANZ declared an interim dividend amount of $0.810, which translates to an annual yield of 6.15%. The bank’s commitment to returning value to its shareholders is further emphasized by its 100% franking rate.

ANZ’s headquarters is situated at ANZ Centre Melbourne, Level 9, 833 Collins Street, DOCKLANDS, VIC, AUSTRALIA, 3008. Those interested in learning more about the bank’s operations, financial products, and services can visit the official ANZ website.

APT – Afterpay Ltd

Afterpay Ltd revolutionized the retail industry with its unique “buy now, pay later” model. Established in 2014, Afterpay allows consumers to purchase products immediately and pay for them in four equal installments, without any interest. This innovative approach to retail financing has made Afterpay a favorite among both retailers and consumers.

BHP – BHP Group Ltd

BHP Group Limited (BHP) is a diversified natural resources company with a rich history dating back to its listing on 13 August 1885. The company’s vast portfolio includes assets, operations, and interests in iron ore, copper, metallurgical coal, nickel, and potash.

Currently, BHP’s stock is trading at a price of $46.100. Over the past year, the stock has experienced a range between $36.130 and $50.210. With a market capitalization of $233.66 billion, BHP stands as one of the major players in the Materials industry group.

From a financial perspective, BHP’s P/E ratio is 11.63, suggesting the valuation investors place on the company relative to its earnings. The company has reported a revenue of $53.81 billion (USD) and a net profit of $12.92 billion (USD). These figures underscore BHP’s robust financial health and its capacity to generate significant returns.

For investors keen on dividends, BHP has declared a final dividend amount of $0.800 (USD), resulting in an annual yield of 5.66%. The company’s commitment to its shareholders is further emphasized by its 100% franking rate.

BHP Group Limited’s headquarters is located at Level 18, 171 Collins Street, MELBOURNE, VIC, AUSTRALIA, 3000. For a deeper dive into the company’s operations, financials, and other relevant details, one can visit the official BHP website.

CBA – Commonwealth Bank of Australia

Commonwealth Bank of Australia (CBA) is one of the leading banking and financial institutions in Australia. Established on 12 September 1991, the bank has grown to become a significant player in the Australian banking sector, offering a wide range of banking, financial, and related services.

As of the latest data, CBA’s stock is trading at a price of $101.510, with a slight decrease of $0.709 (-0.694%) from its previous close. The bank boasts a substantial market capitalization of $171.33 billion, placing it firmly in the Banks industry group.

From a financial standpoint, CBA’s P/E ratio stands at 17.34, indicating the valuation investors place on the bank relative to its earnings. The bank reported a revenue of $27.95 billion (AUD) and a net profit of $10.09 billion (AUD). These figures highlight CBA’s strong financial performance and its ability to generate significant returns for its shareholders.

For dividend-focused investors, CBA has declared a final dividend amount of $2.400, translating to an annual yield of 4.40%. The bank’s commitment to returning value to its shareholders is further emphasized by its 100% franking rate.

For more detailed information or to engage with the bank directly, the Commonwealth Bank of Australia’s head office is located at Commonwealth Bank Place South, Level 1, 11 Harbour Street, SYDNEY, NSW, AUSTRALIA, 2000. The bank’s official website can be accessed here.

CSL – CSL Ltd

CSL Ltd is a renowned company that specializes in the development, manufacturing, and marketing of pharmaceutical and diagnostic products, cell culture media, and human plasma fractions. Established on 08 June 1994, CSL has been at the forefront of the Pharmaceuticals, Biotechnology & Life Sciences industry, offering innovative solutions and products to its global clientele.

At present, CSL’s stock is trading at a price of $271.200, marking an increase of $0.359 (0.132%) from its previous close. The company boasts a significant market capitalization of $130.79 billion.

Financially, CSL’s P/E ratio is 38.42, which provides insight into the valuation investors place on the company in relation to its earnings. The company has reported a revenue of $13.31 billion (USD) and a net profit of $2.19 billion (USD). These figures highlight CSL’s strong financial standing and its capability to generate substantial returns for its stakeholders.

For investors with a focus on dividends, CSL has declared a final dividend amount of $1.290 (USD), resulting in an annual yield of 1.33%. The company’s commitment to its shareholders is further emphasized by its 10% franking rate.

CSL Ltd’s headquarters can be found at 45 Poplar Road, PARKVILLE, VIC, AUSTRALIA, 3052. For more comprehensive information about the company, its products, and other relevant details, one can visit the official CSL website.

FMG – Fortescue Metals Group Ltd

Fortescue Metals Group Ltd (FMG) is a proud West Australian company and stands as the number 1 integrated green technology, energy, and metals company. Established on 19 March 1987, FMG has been a significant player in the Materials industry, focusing on the exploration, development, production, processing, and sale of iron ore.

Currently, FMG’s stock is trading at a price of $20.340, witnessing an increase of $0.289 (1.446%) from its previous close. The company has a substantial market capitalization of $61.73 billion.

From a financial perspective, FMG’s P/E ratio is 8.45, reflecting the valuation investors place on the company relative to its earnings. The company reported a revenue of $16.87 billion (USD) and a net profit of $4.79 billion (USD). These figures emphasize FMG’s robust financial performance and its ability to generate significant returns for its shareholders.

For those interested in dividends, FMG has declared a final dividend amount of $1.000, resulting in an annual yield of 8.72%. The company’s commitment to its shareholders is further highlighted by its 100% franking rate.

Fortescue Metals Group Ltd’s headquarters is situated at Level 2, 87 Adelaide Terrace, EAST PERTH, WA, AUSTRALIA, 6004. For more comprehensive information about the company, its operations, and other relevant details, one can visit the official FMG website.

GMG – Goodman Group

Goodman Group is an integrated property group with operations spanning across Australia, New Zealand, Asia, Europe, the United Kingdom, and the Americas. Comprising the stapled entities Goodman Limited, Goodman Industrial Trust, and Goodman Logistics (HK) Limited, it stands as the largest industrial property group listed on the Australian Securities Exchange. Moreover, it’s recognized as one of the leading specialist investment managers of industrial property and business space on a global scale.

As of the latest data:

- Stock Price: Goodman Group’s stock is trading at $23.09, experiencing a slight decrease of $0.01 (-0.04%).

- Market Capitalization: The company’s market cap is approximately $43.852 billion.

- P/E Ratio: Goodman Group’s P/E ratio is 28.51, which provides an insight into the valuation investors place on the company.

- EPS: The company has an EPS (TTM) of $0.81.

- Dividend & Yield: Goodman Group has declared a forward dividend amounting to $0.30, resulting in a yield of 1.30%.

- 1-Year Target Estimate: The 1-year target estimate for the stock is $24.54.

Goodman Group specializes in creating innovative property solutions tailored to the individual needs of its customers. Their global property expertise, combined with their integrated own+develop+manage customer service offering and significant investment management platform, ensures they remain at the forefront of the industry.

MQG – Macquarie Group Ltd

Macquarie Group Limited is a global financial services group with offices in 25 countries. It’s known for its diversified operations that span across banking, financial, advisory, investment, and funds management services. Being one of the top investment banks in the world, Macquarie has a significant presence in the global infrastructure, renewable energy, commodities, and financial markets.

Here are some key financial details about Macquarie Group Limited:

- Stock Price: The stock is currently trading at $170.21, marking a decrease of $6.71 (-3.79%).

- Market Capitalization: Macquarie boasts a market cap of approximately $65.798 billion.

- P/E Ratio: The P/E ratio for the company is 12.93, indicating the valuation investors are placing on it relative to its earnings.

- EPS: The Earnings Per Share (TTM) is $13.16.

- Dividend & Yield: Macquarie has announced a forward dividend of $7.50, which translates to a yield of 4.24%.

- 1-Year Target Estimate: The 1-year target estimate for the stock is set at $188.84.

Recent news highlights that Macquarie’s private markets’ assets under management (AUM) were down 3% compared to end-March figures. This decline was attributed to the expiration of co-investors’ management rights on a specific asset. Furthermore, the company mentioned that its asset management arm’s net other operating income is significantly lower in the first half due to decreased investment-related income from green energy financing.

For more comprehensive information about Macquarie Group Limited, its operations, and other relevant details, one can visit the official Macquarie website.

NAB – National Australia Bank Ltd

National Australia Bank Limited, commonly referred to as NAB, is one of the four largest financial institutions in Australia in terms of market capitalization, earnings, and customers. Founded in 1834, NAB has grown to become a major player in the Australian and New Zealand banking industries.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 28.66

- Market Cap: AUD 90.811B

- P/E Ratio (TTM): 12.63

- EPS (TTM): 2.27

- Dividend & Yield: 1.66 (5.79%)

- 52 Week Range: 25.10 – 32.83

- Average Volume: 4,797,412

Company Overview

National Australia Bank Limited provides a wide range of financial services, including banking, wealth management, and investment solutions. The bank operates through various segments, including Business and Private Banking, Personal Banking, Corporate and Institutional Banking, New Zealand Banking, and more. With its extensive portfolio of products and services, NAB caters to both individual and business customers.

The bank’s offerings include transaction accounts, savings accounts, deposit accounts, term deposits, home loans, personal loans, business loans, insurance products, credit cards, and much more. Additionally, NAB provides specialized financial services such as foreign exchange solutions, trade and invoice finance, and industry-specific banking services.

With a rich history dating back to the 19th century, NAB has established a strong presence not only in Australia and New Zealand but also on the international stage. The bank’s commitment to customer service, innovation, and sustainable business practices has earned it a reputation as a trusted financial partner for millions of customers.

Recent Performance

NAB’s recent stock performance indicates a year-to-date (YTD) return of 1.67%, slightly underperforming the S&P/ASX 200’s return of 3.10%. However, over a three-year period, NAB has shown a remarkable return of 89.77%, significantly outperforming the S&P/ASX 200’s return of 22.47%.

Conclusion

National Australia Bank Limited continues to be a dominant force in the Australian banking sector. With its comprehensive range of products and services, strong financial performance, and commitment to sustainability and innovation, NAB remains a top choice for investors looking for stability and growth in the banking industry.

NCM – Newcrest Mining Ltd

Newcrest Mining Limited is a prominent name in the mining sector, especially in the gold mining industry. As one of the world’s largest gold mining companies, Newcrest has operations in Australia, Papua New Guinea, Indonesia, and Canada.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 25.67

- Market Cap: AUD 22.955B

- P/E Ratio (TTM): 19.16

- EPS (TTM): 1.34

- Dividend & Yield: 0.54 (2.08%)

- 52 Week Range: 15.72 – 30.28

- Average Volume: 2,261,747

Company Overview

Newcrest Mining Limited specializes in gold and copper exploration, development, and production. The company’s primary focus is on its gold assets, but it also has significant interests in copper mining. With a commitment to responsible mining practices, Newcrest places a strong emphasis on safety, environmental management, and community engagement.

The company operates several mines, including the Cadia mine in New South Wales, Australia, and the Lihir mine in Papua New Guinea. These mines, among others, have positioned Newcrest as a leader in the gold mining industry, producing significant quantities of gold annually.

Recent Developments

Newcrest recently received clearance from Australia’s competition regulator to proceed with its proposed AUD 26.2 billion takeover of Newmont Corp. If the deal materializes, Newcrest shareholders would receive 0.400 Newmont share for each share, implying a value of AUD 29.27 a share. This potential merger would mark one of the largest deals involving an Australian company.

Conclusion

Newcrest Mining Limited’s commitment to sustainable and responsible mining, combined with its robust financial performance and strategic growth initiatives, makes it a notable player in the global mining industry. Investors and stakeholders can expect continued growth and innovation from Newcrest in the coming years.

For more detailed information and the latest updates, you can visit the official Newcrest Mining website.

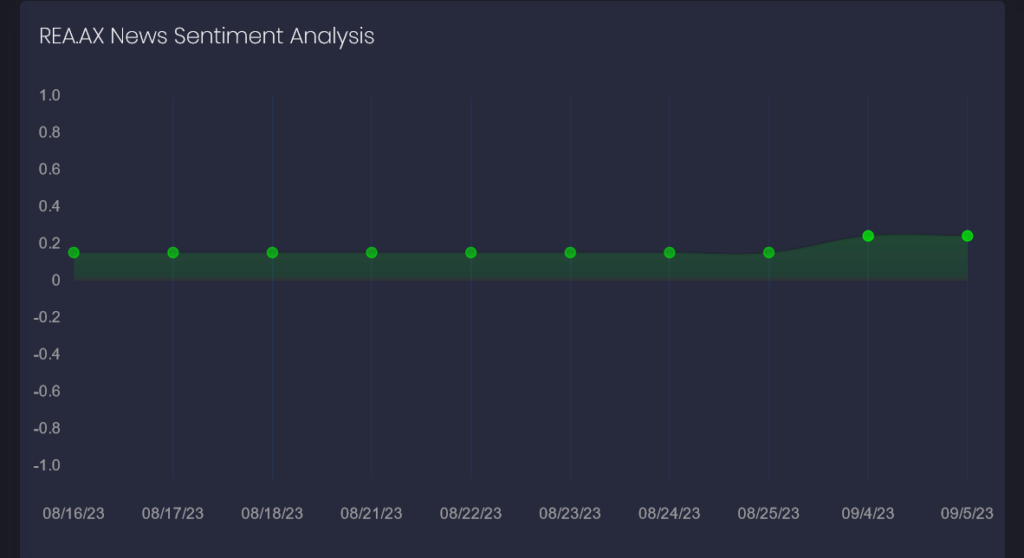

REA – REA Group Ltd

REA Group Limited, headquartered in Melbourne, Australia, is a leading digital advertising company that specializes in property. With its primary operations in Australia and Asia, REA Group has established itself as a dominant player in the online real estate advertising industry.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 170.00

- Market Cap: AUD 21.99B

- P/E Ratio (TTM): 114.75

- EPS (TTM): 1.48

- Dividend & Yield: 1.30 (0.76%)

- 52 Week Range: 110.00 – 175.00

- Average Volume: 295,000

Company Overview

REA Group‘s primary business is to operate Australia’s leading residential and commercial property websites, realestate.com.au and realcommercial.com.au, respectively. The company also has a significant presence in Asia through its ownership of iProperty Group, which operates leading property websites across the region.

In addition to its core property advertising platforms, REA Group offers a range of complementary services, including property data services and financial services products.

Recent Developments

REA Group has been consistently innovating and expanding its product offerings. The company recently launched a new digital platform that provides property developers and builders with a more efficient way to market and sell their projects. This platform aims to streamline the property buying process, making it easier for developers, builders, and consumers alike.

Conclusion

With its strong market position, innovative product offerings, and consistent growth, REA Group Limited remains a top choice for investors looking for exposure to the online real estate advertising industry. The company’s commitment to leveraging technology to improve the property buying and selling experience positions it well for continued success in the future.

RIO – RIO Tinto Ltd

Rio Tinto Group, a global leader in the mining and metals sector, is known for its diversified portfolio of high-quality assets. With operations spanning multiple continents, Rio Tinto is a major player in the extraction of essential resources that drive global economic growth.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 115.98

- Market Cap: AUD 188.142B

- P/E Ratio (TTM): 14.27

- EPS (TTM): 8.13

- Dividend & Yield: 5.22 (4.57%)

- 52 Week Range: 87.60 – 128.78

- Average Volume: 1,392,832

Company Overview

Rio Tinto Group’s operations encompass a range of commodities, including iron ore, aluminum, copper, diamonds, and energy products. The company’s commitment to sustainable mining practices, combined with its innovative approach to technology and automation, has positioned it at the forefront of the mining industry.

Recent Developments

Recent news highlights the challenges and opportunities faced by the mining sector. Reports indicate that companies like BHP Group Ltd. are addressing issues related to the safety and well-being of female employees. Such initiatives reflect the broader industry’s commitment to fostering inclusive and safe work environments.

Conclusion

Rio Tinto Group’s robust financial performance, combined with its strategic investments in technology and sustainability, make it a standout in the global mining sector. The company’s dedication to responsible mining practices and community engagement further solidifies its reputation as a leader in the industry.

TCL – Transurban Group

Transurban Group is a renowned name in the infrastructure sector, primarily focusing on urban toll road networks in Australia and North America. The company is known for its innovative approach to tolling and its commitment to delivering sustainable transport solutions.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 13.02

- Market Cap: AUD 40.203B

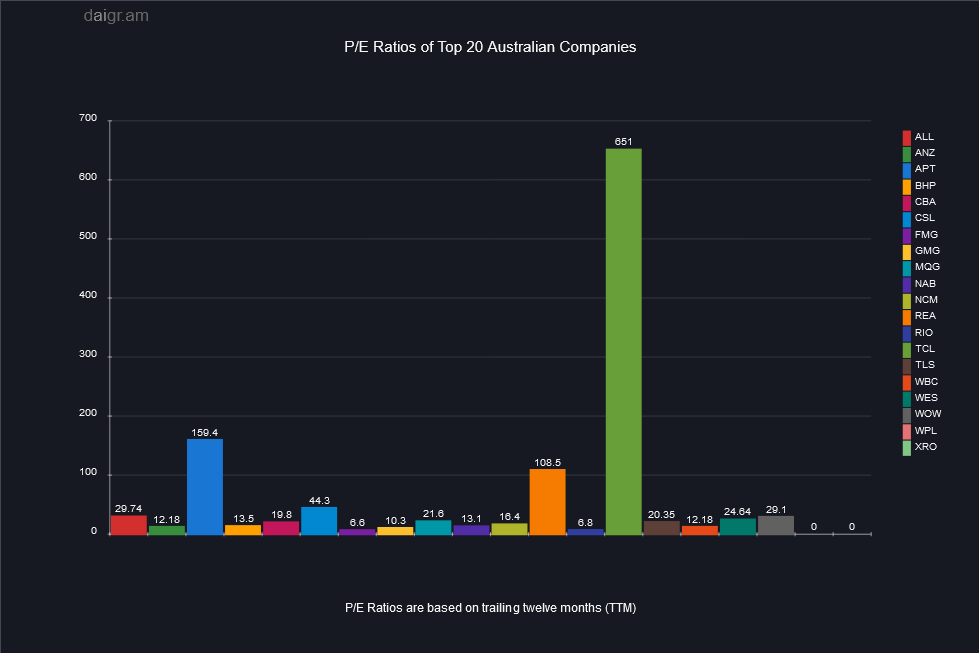

- P/E Ratio (TTM): 651.00

- EPS (TTM): 0.02

- Dividend & Yield: 0.63 (4.77%)

- 52 Week Range: 12.26 – 15.23

- Average Volume: 4,707,014

Company Overview

Transurban Group operates and maintains urban toll road networks in Australia, the United States, and Canada. The company’s primary focus is on partnering with governments to deliver smarter and more efficient transport solutions. Transurban’s toll roads are designed to serve major cities’ key corridors, ensuring smoother and more efficient travel for commuters.

Recent Developments

A recent article highlighted that investors who put their money into Transurban Group five years ago have seen a 42% increase in their investment. This growth showcases the company’s consistent performance and its ability to deliver value to its shareholders.

Conclusion

Transurban Group’s commitment to sustainable infrastructure development, combined with its innovative approach to tolling, positions it as a leader in the urban toll road sector. The company’s continued growth and strong financial performance make it a compelling option for investors looking for stable returns in the infrastructure domain.

For more detailed information and the latest updates, you can visit the official Transurban Group website.

TLS – Telstra Corporation Ltd

Telstra Corporation Limited, commonly known as Telstra, is Australia’s largest telecommunications and media company. Founded in 1975, the company has grown to become a dominant player in the Australian telecommunications market, offering a wide range of services including fixed-line and mobile telephony, broadband, and pay television.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 3.66

- Market Cap: AUD 43.09B

- P/E Ratio (TTM): 20.35

- EPS (TTM): 0.18

- Dividend & Yield: 0.16 (4.37%)

- 52 Week Range: 2.66 – 3.88

- Average Volume: 17,537,000

Company Overview

Telstra’s extensive network infrastructure includes a vast range of fixed-line and mobile services, catering to both individual consumers and businesses. The company has made significant investments in its 5G network, aiming to provide faster and more reliable connectivity to its customers.

Recent Developments

In recent years, Telstra has been focusing on expanding its presence in the Asia-Pacific region. The company has also been investing in new technologies and digital platforms to enhance customer experience and streamline its operations.

Conclusion

With its strong market position, innovative product offerings, and commitment to customer satisfaction, Telstra Corporation Limited remains a top choice for investors looking for exposure to the telecommunications sector in Australia. The company’s ongoing investments in technology and infrastructure position it well for continued growth in the future.

For more detailed information and the latest updates, you can visit the official Telstra website.

WBC – Westpac Banking Corporation

Westpac Banking Corporation, commonly referred to as Westpac, is one of Australia’s “big four” banks and the second-largest bank in New Zealand. Founded in 1817, Westpac is the oldest bank in Australia and has a rich history of serving its customers and communities.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 21.19

- Market Cap: AUD 74.243B

- P/E Ratio (TTM): 12.18

- EPS (TTM): 1.74

- Dividend & Yield: 1.40 (6.50%)

- 52 Week Range: 20.03 – 24.50

- Average Volume: 6,376,738

Company Overview

Westpac offers a broad range of banking and financial services, including consumer, business, and institutional banking. The bank has a strong presence in the Asia-Pacific region and has been focusing on expanding its global footprint.

Recent Developments

Westpac has recently been in the news due to a lawsuit filed by Australia’s corporate regulator over its alleged failure to respond to customers’ financial hardship notices between 2015 and 2022 within the required administrative time frame. This development has brought attention to the bank’s practices and its commitment to customer service.

Conclusion

Despite recent challenges, Westpac remains a significant player in the Australian banking sector. Its long history, extensive service offerings, and commitment to innovation make it a compelling choice for investors looking for exposure to the Australian financial sector. However, potential investors should be aware of the recent legal challenges and their potential implications.

WES – Wesfarmers Ltd

Wesfarmers Limited is one of Australia’s largest diversified corporations, with interests in various sectors, including retail, chemicals, fertilizers, coal mining, and industrial and safety products. Founded in 1914 as a cooperative to provide services and commodities to Western Australian farmers, Wesfarmers has grown into one of Australia’s largest listed companies.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 53.71

- Market Cap: AUD 60.935B

- P/E Ratio (TTM): 24.64

- EPS (TTM): 2.18

- Dividend & Yield: 1.91 (3.55%)

- 52 Week Range: 42.43 – 54.28

- Average Volume: 1,625,721

Company Overview

Wesfarmers has a rich history of serving its stakeholders and has been known for its diversified business model. The company’s primary divisions include Bunnings, Kmart, Target, Officeworks, and an Industrials division with businesses in chemicals, energy, and fertilizers.

Recent Developments

Recent articles highlighted that Wesfarmers’ shareholders would receive a bigger dividend than the previous year. Another article discussed the company’s financial health in relation to its stock performance over the past three months.

Conclusion

Wesfarmers Limited’s diversified business model and commitment to stakeholder value have positioned it as a leading company in the Australian market. Its consistent performance, combined with its strategic investments and acquisitions, make it a compelling choice for investors looking for diversified exposure in the Australian market.

For more detailed information and the latest updates, you can visit the official Wesfarmers Limited website.

WOW – Woolworths Group Ltd

Woolworths Group Limited, commonly known as Woolworths, is a major Australian company with extensive retail interests throughout Australia and New Zealand. Founded in 1924, Woolworths has grown to become the largest supermarket chain in Australia, operating over 1,000 stores across the country.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 40.04

- Market Cap: AUD 50.571B

- P/E Ratio (TTM): 29.94

- EPS (TTM): 1.34

- Dividend & Yield: 0.92 (2.30%)

- 52 Week Range: 36.06 – 42.77

- Average Volume: 2,464,000

Company Overview

Woolworths operates supermarkets under the “Woolworths” brand in Australia and the “Countdown” brand in New Zealand. In addition to its supermarket operations, the company also operates a range of other retail chains, including Big W, Dan Murphy’s, and BWS.

Recent Developments

Woolworths has been focusing on expanding its online and digital offerings in response to changing consumer behaviors. The company has also been investing in sustainability initiatives, aiming to reduce its environmental footprint and promote sustainable practices.

Conclusion

Woolworths Group Limited’s strong market position, extensive retail network, and commitment to sustainability make it a top choice for investors looking for exposure to the Australian retail sector. The company’s ongoing investments in technology and sustainability initiatives position it well for continued growth in the future.

For more detailed information and the latest updates, you can visit the official Woolworths Group Limited website.

WPL – Woodside Petroleum Ltd

Woodside Petroleum Ltd is Australia’s largest independent oil and gas company. With a focus on exploration, development, and production, Woodside is a key player in the energy sector.

XRO – Xero Ltd

Xero Limited is a prominent player in the software industry, specializing in cloud-based accounting software for small and medium-sized businesses. The company’s platform is known for its user-friendly interface, robust features, and integrations with various third-party applications.

Key Financials (as of recent data – Sep 2023)

- Current Stock Price: AUD 122.23

- Market Cap: AUD 18.687B

- 52 Week Range: 62.85 – 127.68

- Volume: 229,837

- Average Volume: 434,913

- PE Ratio (TTM): N/A

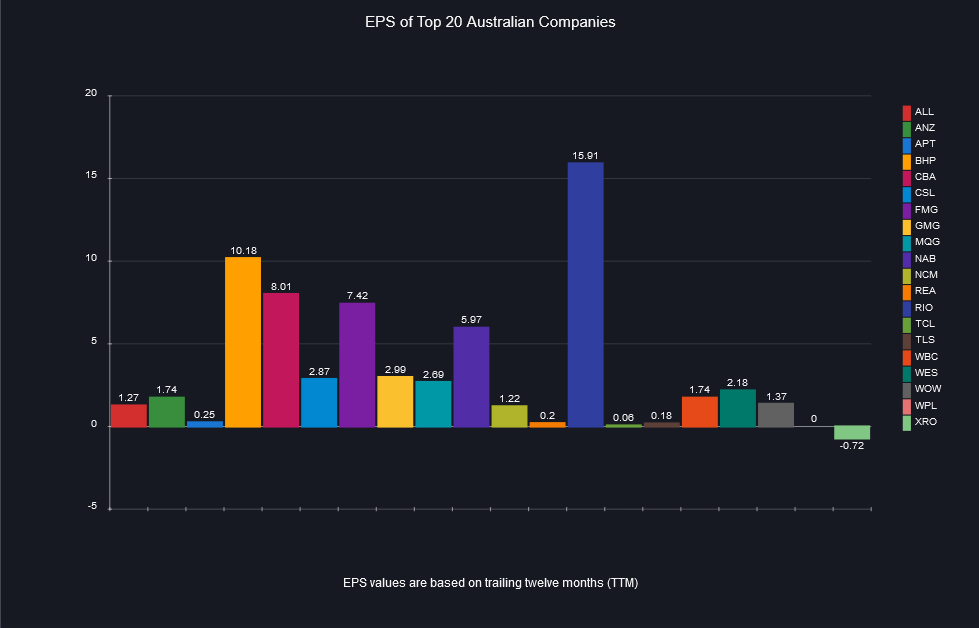

- EPS (TTM): -0.72

- Earnings Date: Nov 09, 2023

- Dividend & Yield: N/A

Company Overview

Xero’s cloud-based accounting software has revolutionized the way small businesses manage their finances. With real-time data access, automated bank feeds, and a plethora of integrations, Xero provides businesses with a comprehensive financial overview. The platform also offers features like invoicing, payroll, reporting, and more, making it a one-stop solution for many businesses’ accounting needs.

Conclusion

Xero Limited’s innovative approach to accounting software has made it a favorite among small and medium-sized businesses. The company’s commitment to continuous improvement and customer satisfaction has positioned it as a leader in the cloud accounting software market. Investors interested in the tech sector, especially in software-as-a-service (SaaS) companies, might find Xero an intriguing option.

Conclusion

The Australian stock market is a dynamic and diverse landscape, home to some of the world’s leading companies across various sectors. From banking giants like ANZ and Westpac to retail powerhouses such as Woolworths and Wesfarmers, the top 20 Australian stocks provide a snapshot of the country’s economic prowess and potential.

Analyzing the financial metrics of these companies, such as market capitalization, P/E ratios, EPS, and dividend yields, offers valuable insights into their performance, stability, and growth prospects. While some companies like Xero are at the forefront of technological innovation in the software industry, others like BHP and Rio Tinto represent Australia’s rich natural resources sector.

The diversity of these top 20 stocks underscores the strength and resilience of the Australian economy. Investors looking to tap into the Australian market can consider these companies as potential avenues for both short-term gains and long-term growth.

However, as with any investment, it’s crucial to conduct thorough research and consult with financial advisors to make informed decisions. The Australian market, with its unique blend of traditional industries and modern innovations, offers a plethora of opportunities for discerning investors.

In conclusion, the top 20 Australian stocks serve as a testament to the country’s economic vitality and its position as a significant player in the global marketplace. Whether you’re an investor, a market enthusiast, or someone keen on understanding the financial landscape down under, these companies provide a comprehensive overview of what Australia has to offer.

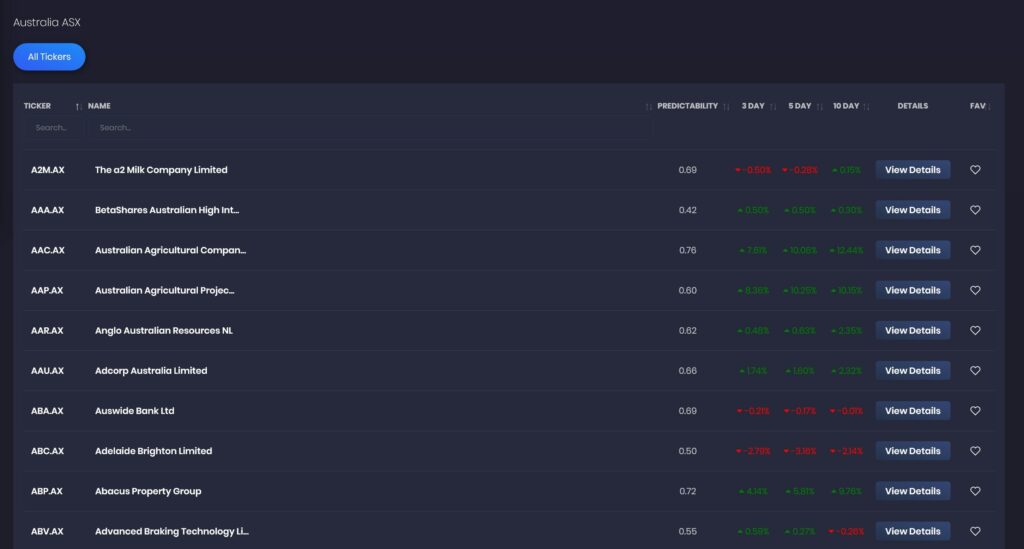

About FinBrain Technologies

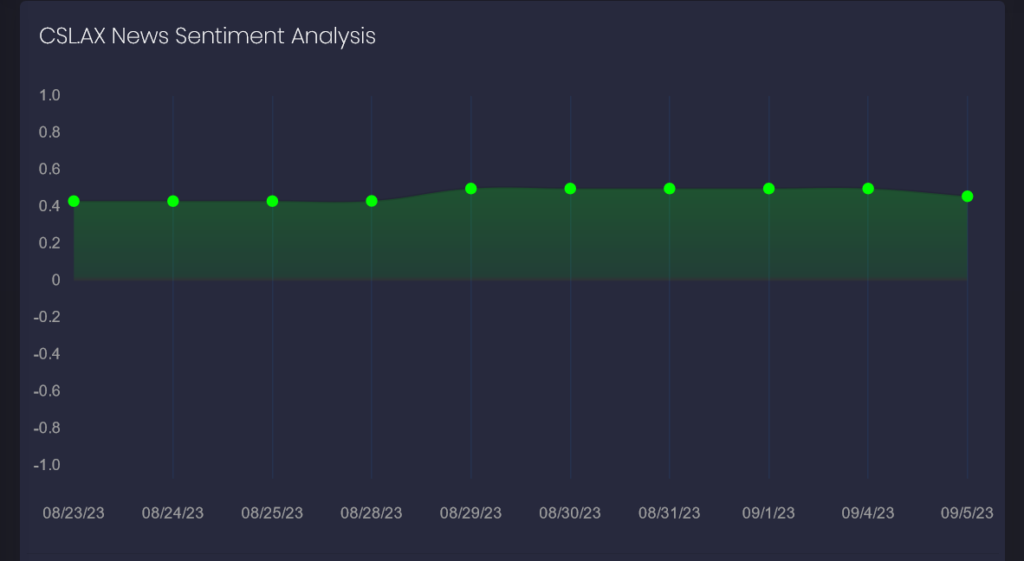

At FinBrain Technologies, we are at the forefront of revolutionizing the financial market landscape by offering AI-driven stock forecasts and a plethora of alternative financial data. Our services encompass a wide range of financial insights, from News Sentiment Analysis and Mobile App Score Ratings to intricate data on US Congress Members’ trades, Option Put-Call ratios, and company insider transactions.

Our primary objective is to harness the potential of AI-assisted and data-driven investing. By doing so, we aim to empower individual investors, enabling them to maximize their investment returns. With our state-of-the-art technology, we cater to traders and investors globally, providing them with AI stock predictions and alternative datasets for an extensive range of US & World Stocks, ETFs, Index & Commodity Futures daily.

Stock Forecasts and Alternative Data Offered by FinBrain

At FinBrain, we pride ourselves on the comprehensive suite of services we offer to our customers, both through the FinBrain Terminal and the FinBrain API:

- AI Generated Future Price Predictions: Our deep neural networks meticulously analyze massive amounts of price, technical, and alternative data daily, ensuring our forecasts are as accurate as possible.

- Company Daily Technical Outlook Reports: We provide a holistic view of a company’s technical status, top holders, earnings and revenue estimates, coupled with analyst recommendations and sentiment scores.

- News & Sentiment Analysis Data: Our advanced AI/NLP algorithms analyze sentiment data based on news collected from over 20 major financial news sources, ensuring our clients stay ahead of the curve.

- US House & Senate Trades: We track trades undertaken by US Representatives and Senators, detailing stock buys/sells and corresponding amounts. Given that US congress members often have access to market-moving information before the general public, tracking their trades can be a lucrative strategy.

- Company Insider Transactions: We provide insights into trades taken by company insiders, detailing transaction types, the number of shares, and dollar amounts.

- Options Put-Call Ratios: Our platform offers the latest traded put-call option contract volumes and ratios, providing clear bullish/bearish signals to our users.

- Mobile App Scores: We offer a unique perspective on a company’s performance by analyzing the satisfaction levels of its app users. This can serve as a leading indicator for forecasting a company’s future performance.

For those looking to delve deeper into the world of AI-driven financial insights, we invite you to visit and register on FinBrain’s website. Join us in redefining the future of investing.

FinBrain Technologies

www.finbrain.tech

[email protected]

99 Wall St. #2023 New York, NY 10005

Twitter • LinkedIn • Instagram • Facebook

Leave a Reply