1. Introduction

1.1 The Power of AI in Stock Prediction

Investing in the stock market has always been a game of strategy and precision, where investors constantly strive to make the most informed decisions. Today, the advent of technology has revolutionized this arena, with Artificial Intelligence (AI) playing a prominent role in transforming the way investors predict stock market trends. Artificial Intelligence stock prediction is a technology that leverages algorithms, machine learning, and data analysis to predict future stock prices and trends. It’s an innovative approach that offers a significant advantage to investors by providing highly accurate, data-driven predictions.

Through the use of machine learning in stock market, AI analyses vast amounts of historical and real-time data, interpreting patterns and trends that are almost impossible for human analysts to discern. By using AI for stock market prediction, investors can gain insights that can guide their investment strategies and potentially lead to higher returns.

1.2 The Role of FinBrain Technologies

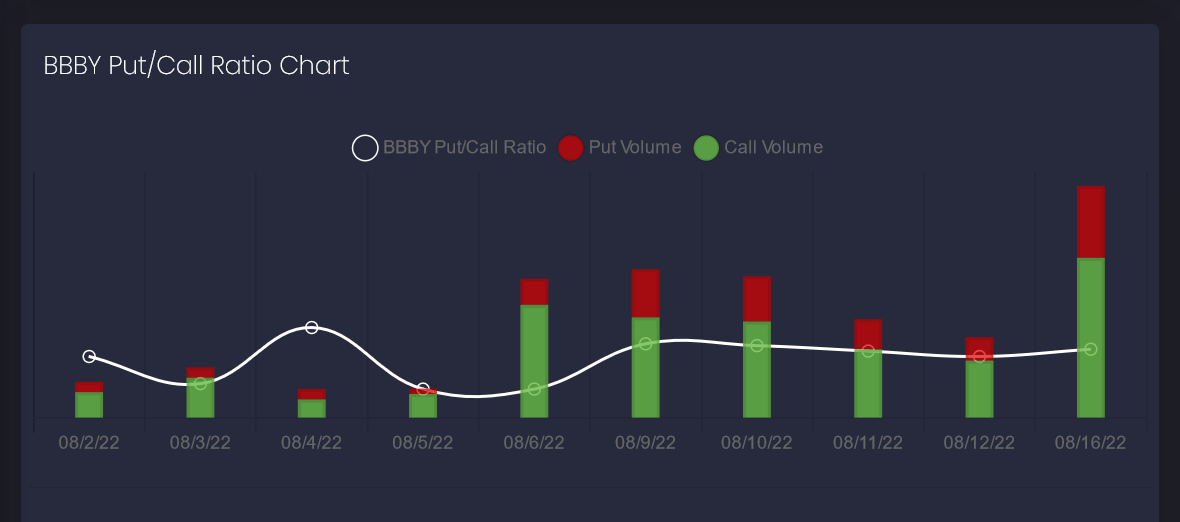

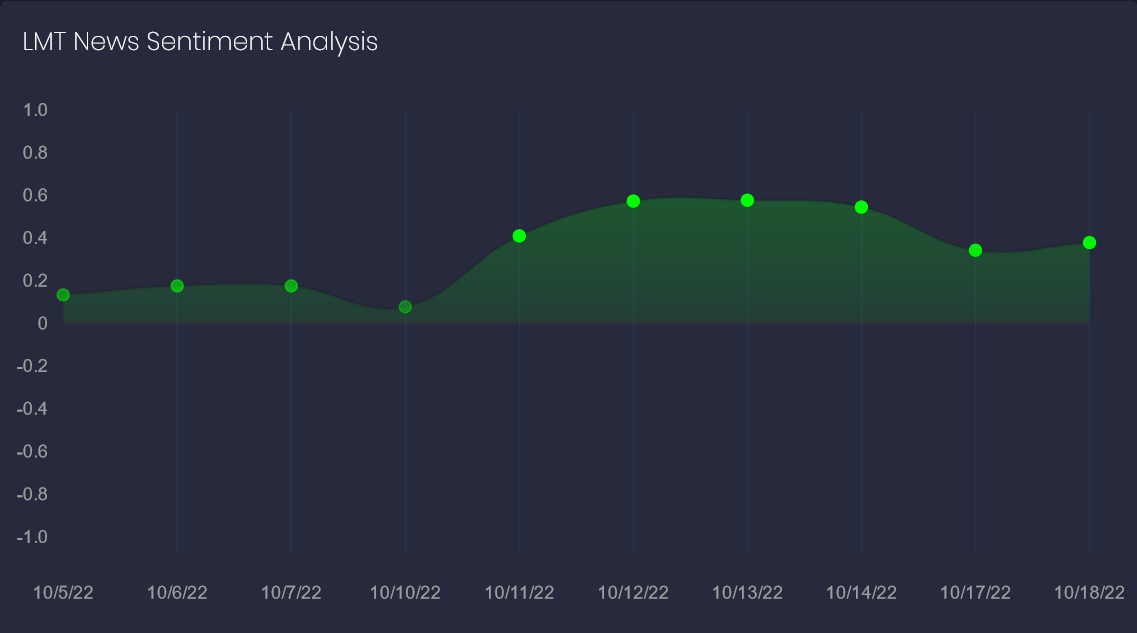

At the forefront of this AI revolution in stock market prediction is FinBrain Technologies. Our company leverages the power of AI and data-driven investing to provide individual investors with AI stock forecasts and Alternative Financial Data. We offer a wide range of services, from News Sentiment Analysis, Mobile App Score Ratings, US Congress Members’ trades, Option Put-Call ratios, to company insider transactions, and much more.

Our FinBrain Terminal and FinBrain API are tools that provide traders and investors from all around the world with AI stock predictions and alternative datasets for thousands of US & World Stocks, ETFs, Index & Commodity Futures on a daily basis. By utilizing our AI-generated future price predictions, company daily technical outlook reports, and sentiment analysis data, investors can make more informed and confident investment decisions.

In the coming sections, we will delve deeper into the inner workings of AI in stock market prediction, the best AI tools for this purpose, and the future of AI in this sector. We will also address common queries related to this technology and its application. Let’s embark on this journey to explore the exciting world of AI and stock prediction.

2. Understanding Artificial Intelligence in Stock Prediction

Artificial Intelligence has become a transformative force in many industries, with the stock market being no exception. Investors and traders are increasingly turning to AI for predictive insights that can guide their investment decisions. Let’s understand the intricacies of this technology and its application in stock prediction.

2.1 How does AI predict stocks?

AI uses complex algorithms and machine learning techniques to analyze vast amounts of data, such as historical stock prices, financial news, market trends, and economic indicators. This data is processed and patterns are identified to create predictive models for future stock behavior. The more data the AI system is exposed to, the more accurate its predictions become, thanks to the self-learning ability of machine learning.

AI’s ability to process huge volumes of data in real-time enables it to identify subtle patterns and correlations that may be missed by human analysts. This allows for a more in-depth and precise analysis, leading to more accurate stock market predictions.

2.2 The Accuracy of AI in Stock Prediction

The accuracy of AI in stock prediction depends on several factors, including the quality of data, the sophistication of the algorithms used, and the complexity of the market conditions. However, AI’s ability to process and learn from vast amounts of data allows it to make highly accurate predictions.

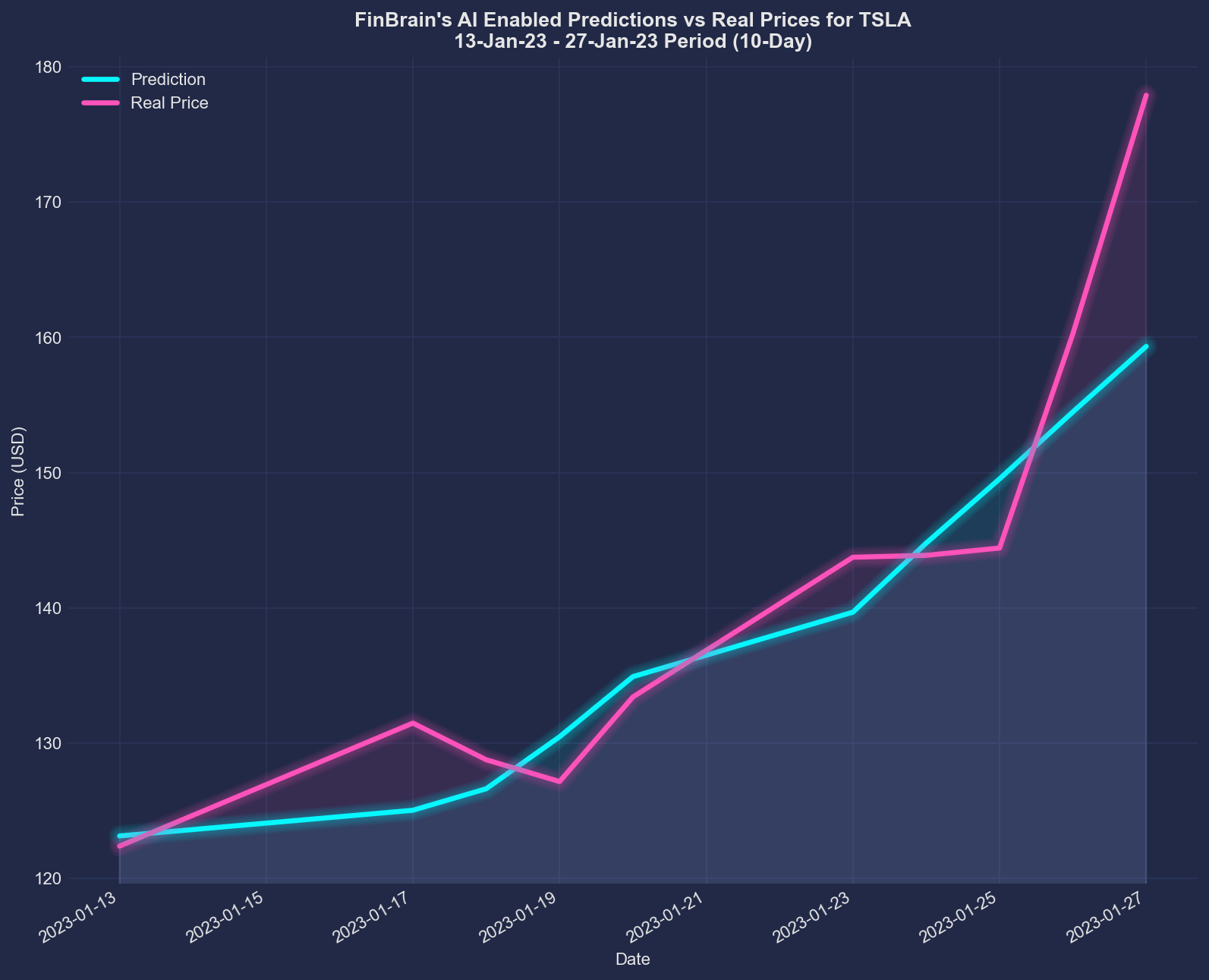

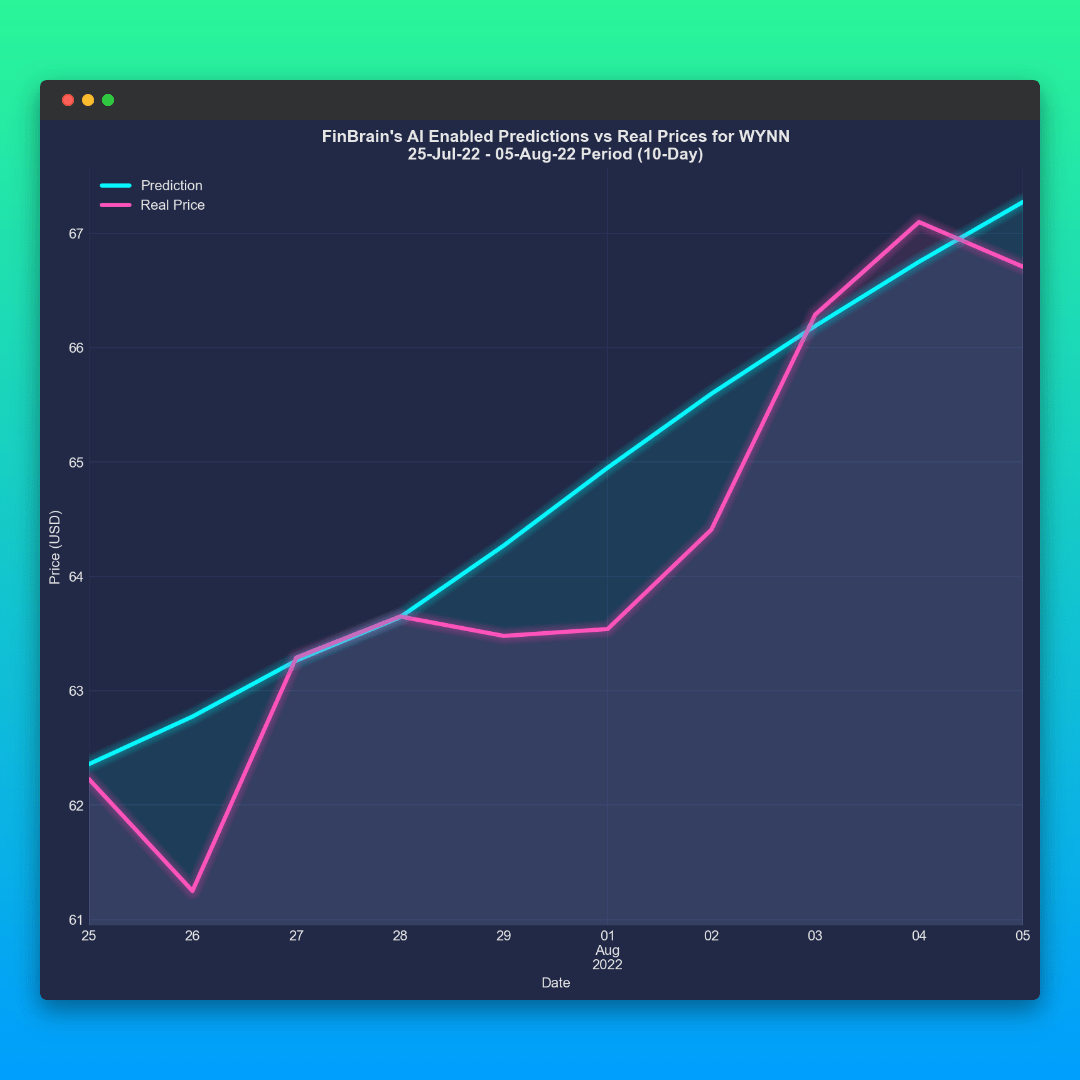

At FinBrain, we have achieved remarkable accuracy in our stock predictions, as evidenced by our success stories with TSLA and S&P500 stocks, among others. This accuracy underscores the potential of AI in making informed and profitable investment decisions.

2.3 The Use of AI for Long-term Stock Predictions

While AI is often associated with short-term predictions, it can also be a valuable tool for long-term stock predictions. By analyzing long-term trends and patterns in historical data, AI can provide insights into the future performance of stocks over extended periods. This is particularly useful for investors who follow a buy-and-hold investment strategy.

However, it’s important to note that while AI can provide valuable insights, it is not infallible. Market conditions can be influenced by a wide range of unpredictable factors, and even the most sophisticated AI cannot predict with 100% accuracy.

2.4 AI and Stock Market Trends

AI’s predictive analytics capability plays a vital role in identifying and understanding stock market trends. By analyzing vast amounts of data, AI can uncover patterns and trends that may not be immediately apparent to human analysts. This can help investors anticipate market movements and make more informed decisions.

From predicting future price movements to identifying profitable trading opportunities, AI’s potential in identifying and leveraging stock market trends is vast. As such, it has become an indispensable tool for modern investors.

3. Exploring the AI Tools for Stock Prediction

The rapidly advancing field of AI offers a multitude of tools and technologies that can aid in stock market prediction. These tools harness the power of machine learning, deep learning, and neural networks to deliver precise and timely predictions.

3.1 Best AI Tools for Stock Prediction

When it comes to Artificial Intelligence stock prediction, it’s important to consider tools that offer accuracy, usability, and extensive data analysis capabilities. Some of these include AI-powered trading platforms, predictive analytics software, and data visualization tools. At FinBrain, we offer a comprehensive suite of AI tools through our FinBrain Terminal and FinBrain API, ensuring that investors have access to the best AI tools for stock prediction.

3.2 Machine Learning and Deep Learning for Stock Prediction

Machine learning, a subset of AI, involves the development of algorithms that enable computers to learn from and make decisions based on data. Deep learning, a more advanced form of machine learning, uses neural networks with multiple layers (hence the “deep” in deep learning) to model complex patterns and relationships in data.

In the context of stock market prediction, both machine learning and deep learning can be used to analyze historical stock data, identify patterns and trends, and predict future stock prices. The predictive models created through these techniques can be continually refined and improved over time, leading to more accurate predictions.

3.3 Neural Networks in Stock Prediction

Neural networks are a type of AI that mimic the human brain’s ability to learn and interpret data. They’re particularly well-suited for recognizing patterns and trends in complex datasets – a key component of stock market prediction.

Neural networks can process numerous inputs (e.g., past stock prices, trading volumes, financial news) to produce an output (e.g., the predicted future stock price). The ability of neural networks to learn from errors and improve their predictions over time makes them an invaluable tool in the world of stock prediction.

3.4 AI Trading Tools and Software

AI trading tools and software streamline the process of stock trading by automating certain tasks and providing predictive analytics. They can execute trades at the optimal time, manage multiple accounts, and provide real-time market data and analysis.

Some examples of AI trading software include robo-advisors, algorithmic trading bots, and AI-powered trading platforms. FinBrain’s Algorithmic Trading bot is one such tool that can trade 24/7 and benefit from the volatility in the crypto markets.

4. The Impact of AI in Financial Markets

Artificial Intelligence has made a significant impact in various sectors, and the financial markets have not been left behind. Its ability to analyze vast amounts of data, identify patterns, and make predictions has transformed how financial markets operate. Here, we explore the role of AI in financial markets and its transformative potential.

4.1 Revolutionizing Trading with AI

AI has revolutionized the way trading is done in financial markets. It has enabled the development of AI trading tools and software that automate trading processes, providing traders with a competitive edge. For instance, algorithmic trading tools, powered by AI, execute trades at high speeds based on predefined algorithms, thus maximizing profitability and minimizing human error.

AI also aids in risk assessment in stock trading, allowing investors to make more informed decisions by predicting potential risks. This enhances the decision-making process, making it more data-driven and less reliant on human intuition.

4.2 Enhancing Market Analysis and Predictions

AI’s ability to process and analyze large datasets has greatly improved market analysis and predictions. AI’s predictive analytics capabilities allow it to analyze historical market data and predict future trends. These accurate predictions can help investors strategize and make more informed decisions, leading to improved returns.

Additionally, Artificial Intelligence stock prediction algorithms can continuously learn and adapt, refining their predictive models to become more accurate over time. For instance, FinBrain’s AI systems have demonstrated remarkable accuracy in predicting stock prices, as seen in our successful forecasts for AAPL and AMZN stocks.

4.3 Transforming Investment Strategies with AI

AI’s impact extends beyond trading and market predictions to influence investment strategies. AI can analyze an investor’s risk tolerance, financial goals, and market trends to recommend personalized investment strategies. This not only simplifies the investment process but also increases the chances of achieving the investor’s financial goals.

AI can also be used for portfolio management, where it can analyze market trends and the performance of various stocks to suggest the optimal portfolio mix for maximum returns.

4.4 The Future of AI in Financial Markets

As AI continues to evolve, its impact on financial markets is set to grow even more. From creating more sophisticated trading bots to generating even more accurate market predictions, the future of AI in financial markets is promising.

While AI cannot entirely replace human judgment, its ability to make data-driven predictions and decisions make it a valuable tool in the financial markets. As such, the use of AI in financial markets is not just a passing trend but a transformative force that is here to stay.

5. AI and Predictive Analytics in the Stock Market

Artificial Intelligence and predictive analytics are transforming the landscape of stock market prediction. By leveraging machine learning and deep learning techniques, AI has been able to deliver predictive analytics that offer valuable insights into market trends and future stock behavior.

5.1 Understanding AI Predictive Analytics

AI predictive analytics involves the use of AI technologies to analyze historical and current data to make predictions about future events. In the context of the stock market, AI predictive analytics can be used to predict future stock prices, trends, and market movements.

AI predictive analytics goes beyond traditional statistical analysis by using machine learning algorithms to identify complex patterns and relationships in the data. This allows for a deeper and more nuanced understanding of market trends and stock behavior, leading to more accurate predictions.

5.2 How AI Enhances Predictive Analytics

AI enhances predictive analytics in several ways. Firstly, AI’s ability to process and analyze vast amounts of data in real time allows for more comprehensive and timely analysis. This is particularly important in the fast-paced world of stock trading, where timely information can mean the difference between profit and loss.

Secondly, Artificial Intelligence stock prediction algorithms can learn and adapt over time, improving their accuracy with each prediction. This self-learning capability allows AI systems to continually refine and improve their predictive models, resulting in increasingly accurate stock market predictions.

Finally, AI can incorporate a wide range of data types into its analysis, including numerical data, text data (such as news articles and social media posts), and even visual data. This ability to analyze diverse data sources provides a more holistic view of the market, leading to more informed predictions.

5.3 AI Predictive Analytics in Action: FinBrain Technologies

At FinBrain Technologies, we leverage the power of AI predictive analytics to provide our customers with accurate and timely stock market predictions. Our deep neural networks analyze massive amounts of price, technical, and alternative data on a daily basis, allowing us to generate future price predictions with a high degree of accuracy.

We also provide our customers with a range of additional resources, such as company daily technical outlook reports, sentiment analysis data based on news from major financial sources, and information on trades taken by US Representatives, Senators, and company insiders. Through these offerings, we empower traders and investors to make more informed and profitable investment decisions.

5.4 The Future of AI and Predictive Analytics in the Stock Market

As AI technologies continue to advance, we can expect to see even more sophisticated predictive analytics in the stock market. This will not only lead to more accurate predictions but also open up new possibilities for trading strategies and investment approaches. As such, AI and predictive analytics will continue to play a crucial role in the future of stock market trading and investment.

6. The Future of AI in Stock Trading

The future of stock trading is inextricably linked with the advances in AI. As the capabilities of AI continue to evolve, we can expect to see significant changes in how stock trading is conducted. The ability of AI to analyze vast amounts of data, identify patterns, and predict future outcomes will play a crucial role in shaping this future.

6.1 Smarter Trading Bots

AI-powered trading bots have already transformed the world of stock trading, and they’re set to become even more sophisticated in the future. Future trading bots will be capable of making more complex trading decisions, and they’ll be able to learn and adapt to changing market conditions in real time. The FinBrain Algorithmic Trading bot is one such tool that illustrates the potential of AI in automating stock trades.

6.2 Greater Accuracy in Stock Predictions

As AI and machine learning technologies continue to evolve, we can expect to see increasingly accurate stock predictions. AI systems will be able to analyze even larger datasets and identify more subtle patterns, leading to more precise forecasts. AI’s predictive models will also continue to learn and improve over time, refining their accuracy with each prediction.

6.3 Personalized Investment Strategies

AI will play a crucial role in the development of personalized investment strategies. By analyzing an investor’s financial goals, risk tolerance, and past investment behavior, AI will be able to recommend tailored investment strategies that maximize returns while minimizing risk. This will make investing more accessible and profitable for individual investors.

6.4 Enhanced Risk Management

AI’s ability to predict market trends and assess potential risks will make it an invaluable tool for risk management in stock trading. AI will be able to provide real-time risk assessments, helping traders to make more informed decisions and avoid potential losses.

6.5 Increased Use of Alternative Data

In the future, AI will be able to analyze even more diverse sources of data, including social media posts, news articles, and even satellite images. This will provide traders with a more comprehensive view of the market, leading to more informed trading decisions. In conclusion, the future of AI in stock trading is bright, with a wealth of opportunities for innovation and improvement.

7. Conclusion

Artificial Intelligence has already begun to reshape the landscape of stock market prediction and trading, and its influence will only continue to grow in the future. With its ability to analyze vast amounts of data in real time, identify complex patterns, and make accurate predictions, AI has revolutionized how we approach stock trading.

AI is not merely a tool for automation; it’s an intelligent system capable of learning, adapting, and improving its predictions over time. This makes it an invaluable asset for traders and investors, enabling them to make more informed decisions, manage risks effectively, and ultimately, maximize their returns.

Companies like FinBrain Technologies are at the forefront of this revolution, leveraging the power of AI to provide accurate stock forecasts and insightful market analysis. Through the use of AI-generated price predictions, sentiment analysis, and alternative data like company insider transactions, FinBrain is helping traders and investors from all around the world make more informed and profitable investment decisions.

Looking ahead, the future of AI in stock trading is promising. From the development of more sophisticated trading bots to the increased accuracy of stock predictions, AI is set to transform the world of stock trading in ways we can only begin to imagine.

The future is bright, and for those willing to embrace the power of AI, the potential for success in the stock market is enormous. As the role of AI in stock market prediction and trading continues to evolve, staying informed and adaptable will be key to staying ahead in this exciting and rapidly changing field.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005

Leave a Reply