Introduction

In the ever-evolving world of technology, Deep Learning Stocks have emerged as one of the most promising investment opportunities. As artificial intelligence (AI) continues to permeate various industries, the appeal of investing in these innovative companies is only set to grow. This comprehensive guide provides a beginner-friendly overview of how to navigate the AI stock market.

What Are Deep Learning Stocks?

Deep learning, a subset of AI, involves algorithms inspired by the structure and function of the brain, called artificial neural networks. Deep Learning Stocks refer to shares of companies that specialize in developing and employing such technologies. These companies range from established tech giants to up-and-coming start-ups.

Companies that utilize deep learning are typically in the tech sector, although the technology’s applications are becoming increasingly widespread across other industries. Some examples of deep learning stocks include Tesla, Nvidia, CrowdStrike Holdings, Palantir Technologies, C3.ai Inc., Alphabet Inc. , Snowflake Inc., and Docusign Inc.. These companies are innovating in their respective fields by integrating deep learning technology into their products and services.

Why Invest in Deep Learning Stocks?

Investing in deep learning stocks can provide several benefits, making them an exciting prospect for investors. Here are a few reasons why:

- Technological Advancement: Deep learning is at the forefront of technological innovation. It is increasingly being used in a variety of applications, from self-driving cars to voice assistants, predictive analytics, and personalized content recommendations. As the technology continues to evolve, the potential for growth is substantial.

- Market Growth: The AI market is projected to grow exponentially in the coming years. As a subset of AI, deep learning is expected to play a significant role in this growth. By investing in deep learning stocks, investors can potentially ride this wave of expansion.

- Competitive Edge: Companies that effectively use deep learning can gain a significant competitive advantage. They can improve their products and services, streamline operations, and make more data-driven decisions, potentially boosting their profitability and stock price.

- Long-term Potential: While some technology trends may come and go, deep learning has the potential for long-term impact across many industries. From healthcare to finance, transportation, and entertainment, its applications are vast and growing.

- Diversification: Deep learning stocks can add diversification to an investment portfolio. They can provide exposure to the tech sector and the rapidly evolving AI industry, which can be beneficial in terms of risk management.

Notably, the Top AI Stocks in 2023 have demonstrated impressive performances, indicating the potential profitability of these investments.

Risks Involved in AI Investment

While investing in deep learning stocks can be rewarding, it’s not without risk. Here are some key factors to consider:

- Market Volatility: Like all stocks, AI stocks are subject to market volatility. Economic indicators, political developments, and market sentiment can all affect stock prices.

- Technological Obsolescence: The tech industry moves at a rapid pace. If a company cannot keep up with evolving technologies, it could quickly become obsolete, impacting its stock value.

- Regulation: Governments are still figuring out how to regulate AI, and new laws or regulations could impact certain companies or the sector as a whole.

- Competition: The AI field is highly competitive. A company that cannot keep pace with its competitors may struggle, which could affect its stock price.

- Implementation Challenges: Many companies are still in the early stages of incorporating AI into their operations. Difficulties in implementation could slow growth and affect investor sentiment.

- Dependence on Data: AI systems rely on vast amounts of data. Issues around data privacy, security breaches, or loss of data could severely impact an AI company.

- Economic Conditions: Broad economic conditions can affect investment in AI. During economic downturns, companies may cut back on AI investments, which could impact AI companies’ revenues and stock prices.

Investors need to weigh these risks against potential rewards. Thorough research and due diligence, along with a well-diversified portfolio, can help manage these risks. Consider using platforms like FinBrain to access AI stock forecasts and other crucial data to guide your investment decisions.

How to Start Investing in Deep Learning Stocks

Before investing in deep learning stocks, it’s essential to understand the market dynamics and the performance of various companies. Platforms like FinBrain offer AI stock forecasts, helping investors make informed decisions.

Deep Learning Investment Guide

Here are the key steps to follow when investing in deep learning stocks:

- Research: Start by understanding the AI industry and the top-performing stocks. Look for companies with strong growth potential and robust financial health.

- Risk Assessment: Consider the potential risks associated with AI investments. This involves looking at market volatility and the specific risks associated with individual companies.

- Investment Platform: Choose a reliable AI Investment Platform to buy and sell stocks. Platforms like FinBrain Terminal offer comprehensive AI stock forecasts and other valuable data.

- Diversification: Don’t put all your eggs in one basket. Diversify your portfolio to spread the risk.

- Monitor: Keep track of your investments and the market trends. Regularly review and adjust your portfolio as necessary.

Top Deep Learning Stocks to Buy

When it comes to selecting the best deep learning stocks to buy, it’s essential to consider companies’ growth potential and the wider trends in the AI industry. Here are some top AI companies to invest in:

- Tesla (NASDAQ:TSLA): Tesla isn’t just an electric vehicle manufacturer. Its autopilot system heavily relies on AI and deep learning for autonomous driving capabilities. Tesla’s approach to deep learning and AI is innovative and has the potential for significant growth.

- Nvidia (NASDAQ:NVDA): Nvidia is a leading player in the graphics processing unit (GPU) market, which is critical for AI computations. Its AI platform and deep learning technologies are being used in various applications, from gaming to autonomous vehicles, making it a strong investment candidate.

- CrowdStrike Holdings (NASDAQ:CRWD): CrowdStrike’s cybersecurity solutions leverage AI and machine learning to offer advanced threat detection. As cyber threats become more sophisticated, the demand for such technology is expected to grow.

- Palantir Technologies (NYSE:PLTR): Palantir provides software that allows organizations to integrate their data, decisions, and operations into one platform. Its AI-driven data analytics capabilities make it a potential growth stock.

- C3.ai Inc (NYSE: AI): As the name suggests, C3.ai is centered on AI applications. It provides an enterprise AI platform for digital transformation, a promising field with potential for significant growth.

- Alphabet Inc. (NASDAQ:GOOG): As Google’s parent company, Alphabet is at the forefront of AI research and application. From search algorithms to autonomous driving, AI is deeply integrated into its diverse product portfolio.

- Amazon.com, Inc. (NASDAQ:AMZN): Amazon uses AI in a wide range of its services, from its recommendation engine to its cloud computing platform, Amazon Web Services (AWS). Its ongoing innovation in AI technology underpins a solid investment case.

- Microsoft Corporation (NASDAQ:MSFT): Microsoft’s Azure cloud platform offers AI services that cater to businesses of all sizes. Its investment in AI research and development suggests a strong future growth trajectory.

- Snowflake Inc. (NYSE: SNOW): Snowflake’s cloud-based platform allows businesses to store and analyze data in a more efficient and scalable way. Its platform uses AI to enhance data analysis, making it a valuable asset in the AI sector.

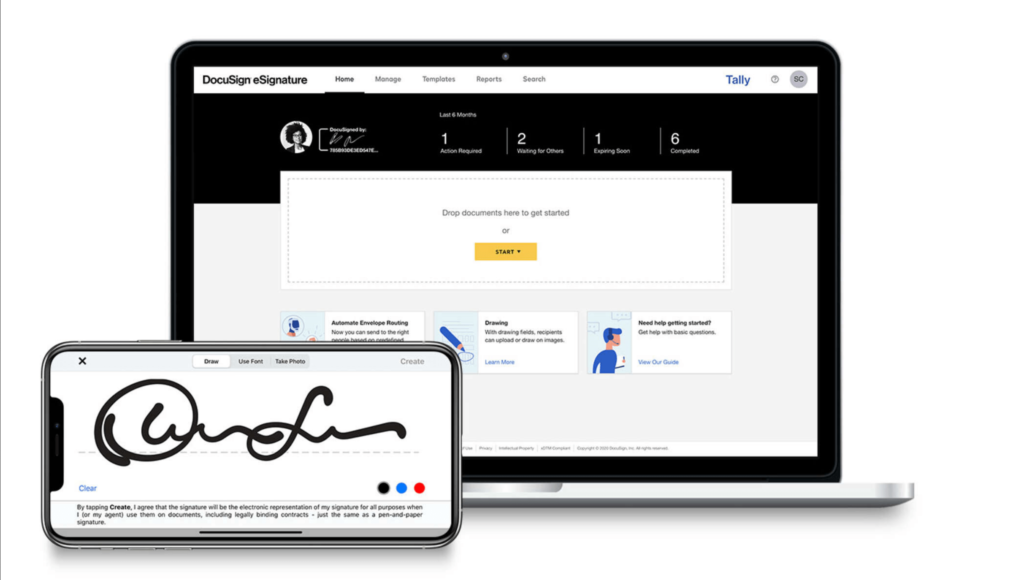

- Docusign Inc. (NASDAQ: DOCU): Docusign’s e-signature service uses AI to understand and automate document processing. As more businesses digitize their processes, the demand for such services is set to increase.

Before investing, it’s crucial to analyze each company’s financial health, growth prospects, and the potential risks involved. Consider using a platform like FinBrain to access detailed AI stock forecasts and other key data to make informed investment decisions.

Analyzing the Performance of Deep Learning Stocks

When it comes to investing in deep learning stocks, understanding how to analyze their performance is essential. Here are some factors to consider:

- Financial Indicators: Analyze the company’s financials, including revenue growth, profit margins, and return on equity.

- Market Position: Consider the company’s market position, competitive advantages, and how effectively it uses deep learning technology.

- Growth Potential: Evaluate the company’s growth potential in its industry and the potential growth of the industry itself.

- Management Team: The competence and vision of a company’s management team can significantly influence its success.

- Stock Price Trends: Assess the stock’s historical price trends and volatility.

While the above steps provide a basic framework, analyzing stock performance can be complex, particularly with deep learning stocks, given the fast-evolving nature of AI technology.

This is where tools like FinBrain come into play. FinBrain provides AI stock forecasts, helping investors understand potential future stock performance. Their FinBrain Terminal allows traders and investors worldwide to access AI stock forecasts and alternative data in their investment decisions.

FinBrain’s API can be used by institutional traders and data-driven funds to leverage the power of the massive amounts of data that FinBrain provides. They also offer a Most Mentioned Tickers on WallStreetBets tracker for those interested in the sentiment of the retail trading community.

Best Platforms to Buy Deep Learning Stocks

Choosing a reliable platform is vital when investing in deep learning stocks. Here are some of the top brokerages and platforms for buying these stocks:

- E*TRADE: E*TRADE is a popular online brokerage that provides a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Its intuitive platform and extensive research resources make it suitable for both beginners and experienced traders.

- TD Ameritrade: TD Ameritrade offers commission-free online stock, ETF, and options trades. Its comprehensive research and educational resources make it a good option for new traders, while its advanced trading platforms cater to more experienced investors.

- Fidelity: Fidelity is known for its research and data. Investors can access a wealth of information, from market analysis to individual stock details. Its zero-commission policy for online U.S. stocks and ETFs is also a significant advantage.

- Charles Schwab: Charles Schwab offers a mix of high-quality services and rich research resources. Its platform is user-friendly, and it offers comprehensive educational content, making it ideal for new investors.

- Robinhood: Known for its easy-to-use platform and commission-free trades, Robinhood is a good choice for beginners. Its simple interface makes trading straightforward, though it offers fewer research tools than some other platforms.

Before choosing a platform, consider factors like fees, the availability of research resources, the user interface, and customer service quality. Remember, the best platform for you depends on your personal trading preferences and needs.

AI Stock Market Forecast

Predicting the future performance of AI stocks involves analyzing market trends, economic indicators, and company-specific factors. With the help of AI technology, platforms like FinBrain can provide accurate AI stock market forecasts. To see how FinBrain has achieved remarkable forecast accuracy for various stocks, refer to their TSLA stock forecast, S&P 500 stocks forecast, AAPL stock forecast, and AMZN forecast performance.

Conclusion

Investing in deep learning stocks can be a rewarding endeavor with the potential for significant returns. However, like any investment, it requires careful consideration, research, and risk management. Platforms like FinBrain can provide invaluable support, offering AI-driven stock forecasts and a wealth of alternative financial data. For a more detailed understanding of AI investments, consider reading this article on Top AI ETFs: The Key to Unlocking Investment Success and this piece on Top publicly traded companies that leverage the power of AI and how it might affect their stock prices.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005

Leave a Reply