Introduction

Understanding stock forecasts can be crucial in making informed investment decisions. In this guide, we’ll explore what stock forecasts are, their accuracy, their role in investment strategies, and the role of AI and machine learning in predicting stock trends.

What is a Stock Forecast?

A stock forecast is a prediction of the future performance of a particular stock or the stock market as a whole. These predictions can be based on various factors, including company fundamentals, technical analysis, market conditions, and more. Investors use stock forecasts to inform their decisions on whether to buy, sell, or hold particular stocks.

How Accurate Are Stock Forecasts?

Stock forecast accuracy depends on several factors, such as the methodology used, the timeframe of the prediction, and the prevailing market conditions. While no stock forecast can guarantee 100% accuracy, some models and platforms have proven to be more reliable than others. It’s essential to consider multiple sources and factors when relying on stock forecasts for investment decisions.

Can Stock Forecasts Help with Investment Decisions?

Yes, stock forecasts can be a valuable tool for investors, helping them make informed decisions and mitigate risks. By analyzing various factors and market conditions, forecasts can provide insights into the potential future performance of stocks. However, it’s essential to use stock forecasts as one part of a broader investment strategy, rather than relying solely on them.

Factors Considered in Stock Forecasts

Stock forecasts consider a wide range of factors, including:

- Company fundamentals, such as revenue, earnings, and debt levels

- Technical analysis, including stock price trends and trading volume

- Market conditions, such as interest rates and economic indicators

- Industry-specific trends and news

- Sentiment analysis, gauging investor sentiment and opinions

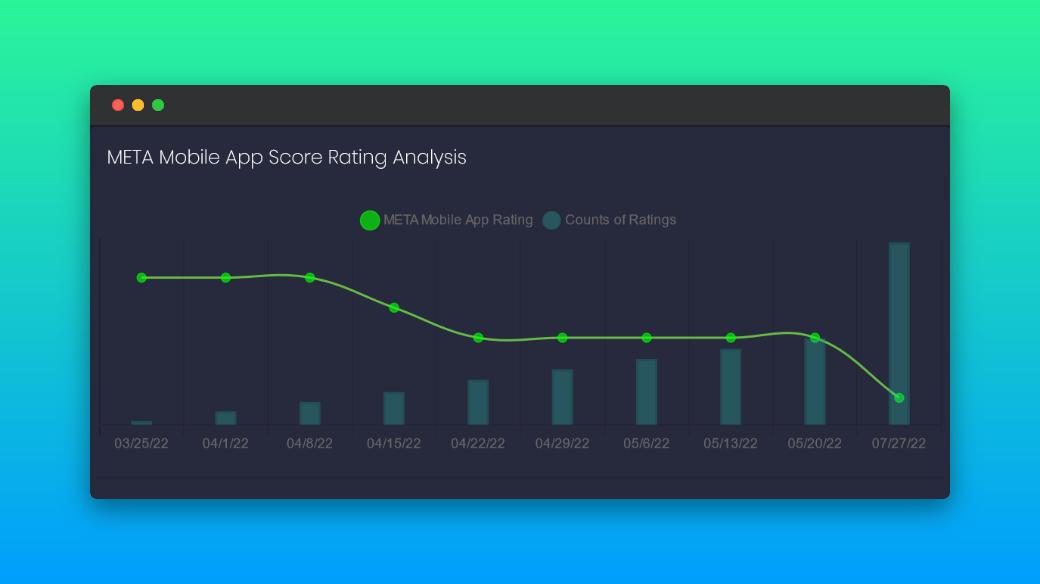

- Mobile app scores and options put-call data

Reliable Stock Forecast Sources and Platforms

There are several platforms and sources available for reliable stock forecasts, including FinBrain, which offers AI-powered stock forecasts and alternative data for investment decisions. Additionally, FinBrain Terminal provides traders and investors with access to AI stock forecasts and data from around the world.

Institutional traders and data-driven funds can leverage FinBrain’s massive data through FinBrain API. Additionally, FinBrain’s Most Mentioned Tickers on WallStreetBets tracker can provide insights into popular stocks on social media platforms.

Free Stock Forecast Services

There are several free stock forecast services available, but it’s crucial to remember that their reliability and accuracy may vary. Some popular free services include Yahoo Finance, TradingView, and Google Finance. However, premium services like FinBrain often provide more comprehensive and accurate forecasts.

Short-term vs. Long-term Stock Forecasts

Stock forecasts can predict both short-term and long-term trends. Short-term forecasts typically focus on daily or weekly price movements, while long-term forecasts look at trends over months or years. The accuracy of these predictions varies based on the factors considered and the forecasting model used.

Limitations of Stock Forecasts

Stock forecasts have several limitations, including:

- Inherent uncertainty and unpredictability of the stock market

- Varying accuracy depending on the model and methodology used

- The potential for unforeseen events to impact stock prices

It’s essential to consider these limitations and use stock forecasts as part of a well-rounded investment strategy.

Interpreting and Utilizing Stock Forecasts Effectively

To interpret and utilize stock forecasts effectively, consider the following tips:

- Combine forecasts with other research and analysis tools

- Evaluate the reliability and accuracy of the forecasting source

- Consider multiple sources and perspectives for a more comprehensive understanding

- Use forecasts as a starting point for further investigation, rather than relying solely on them

- Be aware of the limitations and potential biases of the forecasts

- Monitor the performance of the forecasts to assess their accuracy over time

- Adjust your investment strategy as needed based on the forecasts and other relevant factors

Successful Examples of Stock Forecasts in the Past

While no stock forecast is perfect, some have successfully predicted market trends or specific stock movements. For example, during the 2008 financial crisis, some forecasters correctly predicted the market’s downturn. Additionally, AI-driven stock forecasts have shown success in recent years, particularly in volatile markets, where traditional methods may struggle.

The Role of AI and Machine Learning in Stock Forecasts

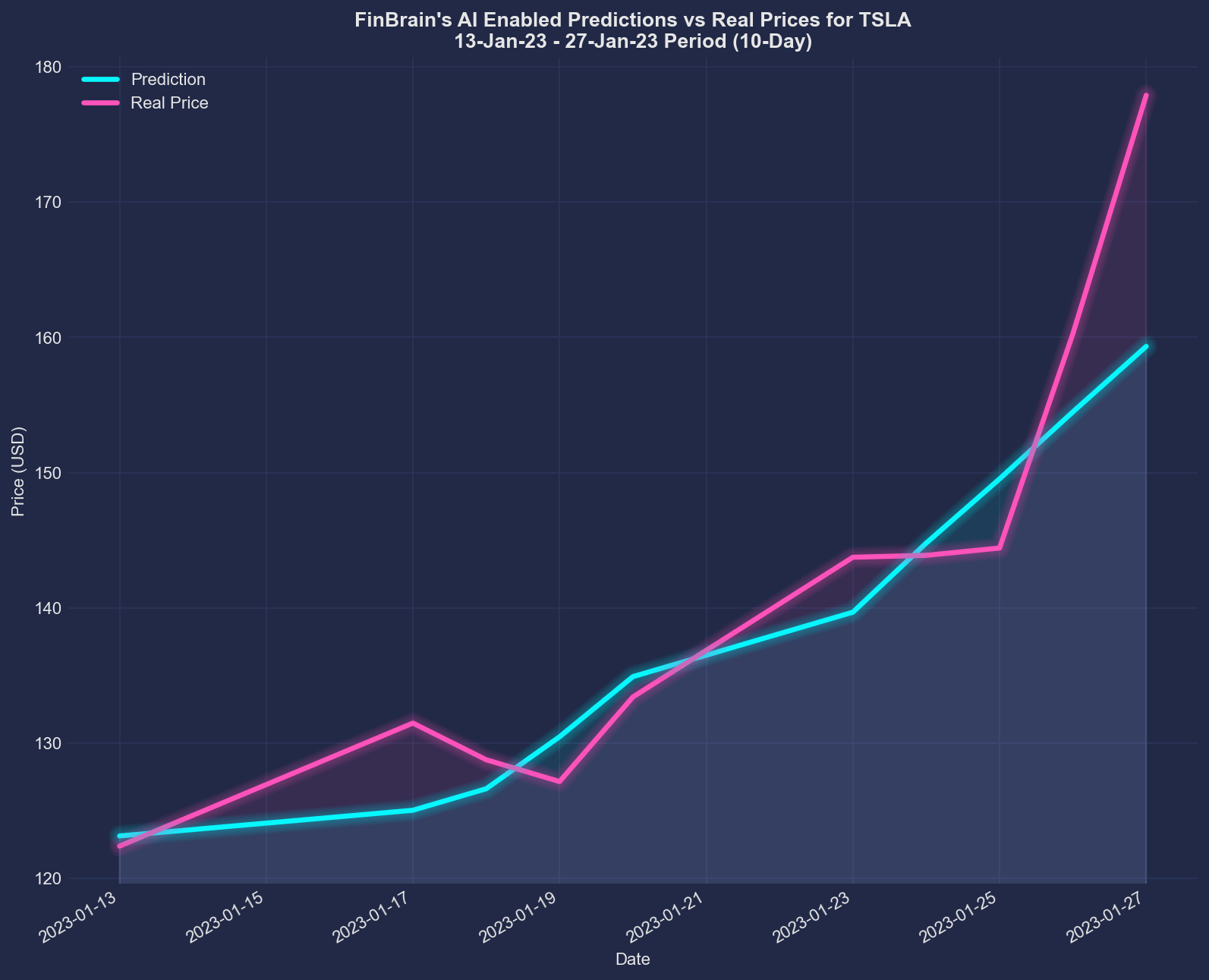

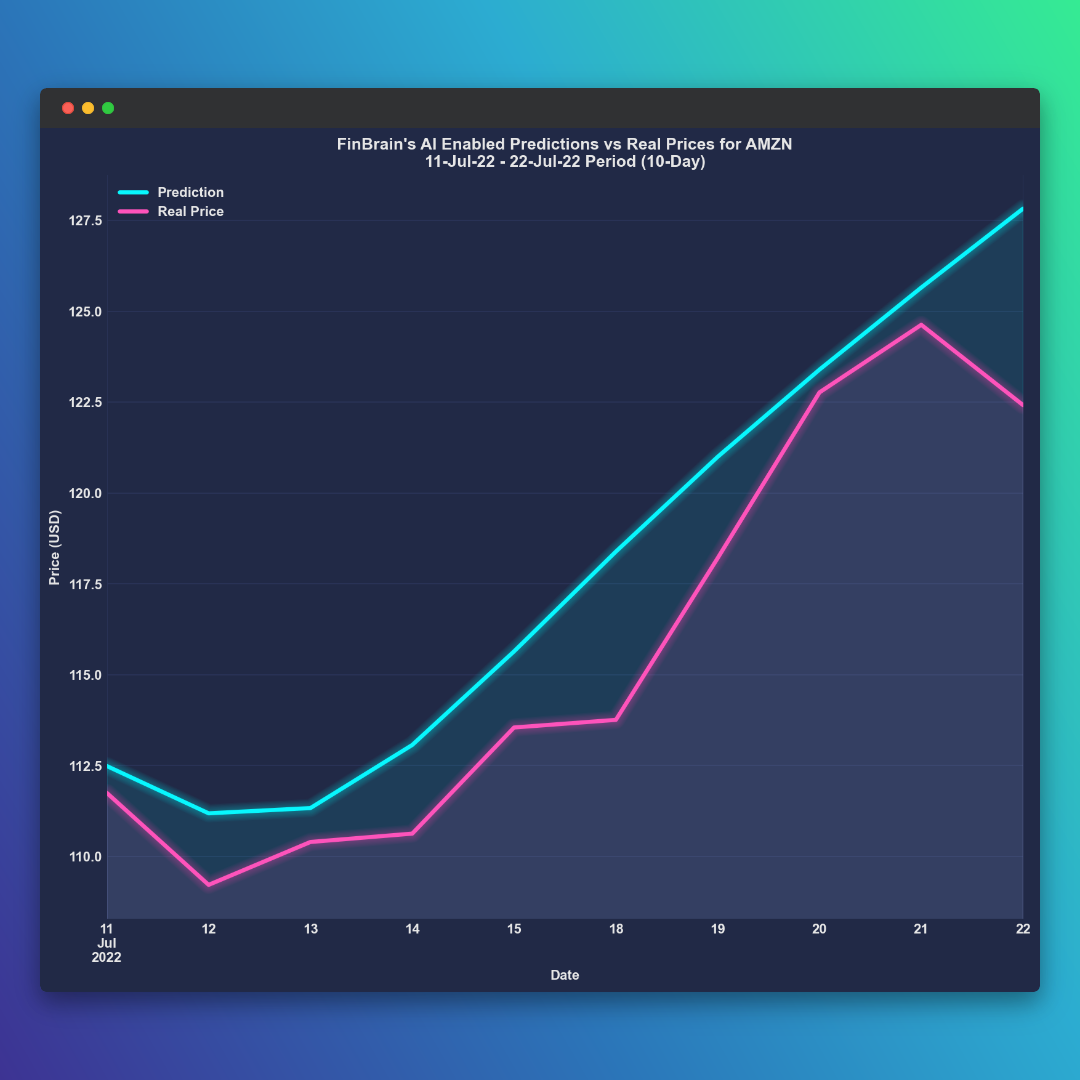

AI and machine learning have revolutionized stock forecasting by enabling more sophisticated models that can analyze vast amounts of data in real-time. These technologies can identify patterns and relationships that may be difficult for humans to detect, leading to more accurate and timely forecasts.

AI-powered stock forecast models like those offered by FinBrain leverage machine learning algorithms to continuously learn and improve their predictions. This approach can lead to better predictions and more informed investment decisions.

In conclusion, stock forecasts can be a valuable tool for investors when used correctly. By understanding their limitations and utilizing them alongside other research and analysis tools, investors can make more informed decisions and better manage their investment portfolios. AI and machine learning technologies have further improved the accuracy and effectiveness of stock forecasts, making them an essential part of any modern investment strategy.

Stock Forecast for Beginners

For beginner investors, understanding and utilizing stock forecasts can seem daunting. Here are some tips to help you get started:

- Educate yourself: Learn about stock market basics, stock forecasting methodologies, and different types of stock forecasts.

- Choose reliable sources: Find trustworthy stock forecast platforms and sources, like FinBrain, that provide accurate and comprehensive forecasts.

- Start with a long-term perspective: Focus on long-term stock forecasts, as they are generally more stable and easier to understand for beginners.

- Diversify: Use stock forecasts to help you build a diversified portfolio, reducing risk by investing in various sectors and industries.

- Monitor and adjust: Keep track of the performance of your investments and the accuracy of the stock forecasts you rely on. Adjust your investment strategy as needed based on the forecasts and other relevant factors.

Stock Forecasts for Specific Companies and Sectors

Stock forecasts can be tailored to specific companies, industries, or sectors. This can help investors gain insights into the potential performance of individual stocks or groups of stocks within a specific industry. Platforms like FinBrain Terminal offer comprehensive coverage of individual stocks and sectors, providing AI stock forecasts and alternative data for all tickers listed under various stock markets, including the US, UK, German, Canadian, Australian, Saudi, Mexican, Russian, Brazilian, and Israeli markets.

FinBrain Terminal stands out from other forecasting platforms due to its unique hedge fund grade data for world stocks, which is not available publicly anywhere else. This level of detailed information and extensive coverage enables traders and investors to make well-informed decisions based on accurate forecasts tailored to specific companies and sectors.

By accessing this in-depth data, investors can gain a competitive edge in the market, allowing them to identify potential opportunities and trends within various industries and regions. Utilizing FinBrain Terminal’s AI-driven stock forecasts can greatly enhance an investor’s ability to analyze specific companies, sectors, and global markets, ultimately leading to more informed investment decisions.

Stock Forecasts vs. Actual Performance

While stock forecasts can provide valuable insights into potential future performance, it’s crucial to compare these predictions with actual stock performance over time. This can help you assess the accuracy of the forecasts and adjust your investment strategy accordingly.

Several case studies demonstrate the effectiveness of certain forecasting methods in predicting actual stock performance:

- FinBrain’s remarkable forecast accuracy for TSLA stock highlights the platform’s ability to predict Tesla’s stock price movements with high precision.

- The most accurate way to forecast S&P 500 stocks showcases FinBrain’s impressive results in predicting the performance of stocks within the S&P 500 index.

- How to forecast AAPL stock prices with high accuracy demonstrates the effectiveness of FinBrain’s methods in accurately predicting Apple’s stock prices.

- Why FinBrain is the best stock prediction website: AMZN forecast performance highlights the platform’s success in forecasting Amazon’s stock performance.

Keep in mind that stock forecasts are not guarantees of future performance, and it’s essential to monitor and adjust your investment approach based on the actual results and other relevant factors.

Stock Forecasts for Different Timeframes

Stock forecasts can be provided for various timeframes, including short-term (daily or weekly), medium-term (monthly), and long-term (yearly). The appropriate timeframe for your investment strategy will depend on your financial goals and risk tolerance.

Short-term forecasts may be more useful for day traders and those looking to capitalize on quick market movements. In contrast, long-term forecasts can be more suitable for investors with a buy-and-hold strategy or those focused on long-term growth.

In conclusion, stock forecasts can be a valuable tool for investors of all levels of experience and across various investment timeframes. By understanding the different types of forecasts available and how to use them effectively, you can make more informed decisions and better manage your investment portfolio.

Stock Forecast Indicators and Models

There are various stock forecast indicators and models used by analysts and investors to predict future stock performance. Some popular indicators and models include:

- Moving Averages: These are calculated by averaging the stock price over a specific time period, helping identify trends and potential support or resistance levels.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements, indicating whether a stock is overbought or oversold.

- Bollinger Bands: These bands are used to measure the stock’s volatility and identify potential buy or sell signals.

- Fundamental Analysis: This approach focuses on evaluating a company’s financial health, management, and industry position to determine its intrinsic value.

- Technical Analysis: This method analyzes historical price and volume data to identify patterns and trends that may indicate future price movements.

It’s essential to understand the various indicators and models available, as well as their limitations, to make informed decisions based on stock forecasts.

Stock Forecast Algorithms and Analysis

Modern stock forecasting techniques leverage advanced algorithms and data analysis tools to provide more accurate and timely predictions. These algorithms can process vast amounts of data, including company financials, market trends, and social media sentiment, to identify patterns and correlations that may predict future stock performance.

Machine learning and AI-driven algorithms, such as those used by FinBrain, can continuously learn from new data, adapting and refining their predictions over time. This dynamic approach can lead to improved forecasting accuracy and better-informed investment decisions.

Stock Forecast Tools

There is a wide range of stock forecast tools available to investors, from free platforms like Yahoo Finance and Google Finance to premium services like FinBrain Terminal. These tools often provide various features, including:

- Stock forecasts for individual companies or entire sectors

- Customizable watchlists and alerts

- Technical and fundamental analysis tools

- Real-time data and charting capabilities

- Portfolio tracking and performance analysis

When selecting a stock forecast tool, consider factors such as the platform’s reliability, accuracy, features, and cost to find the best fit for your investment strategy.

Final Thoughts

Stock forecasts can play a vital role in informing investment decisions and managing risk. By understanding the various types of forecasts, their limitations, and how to utilize them effectively, investors can make more informed decisions and better manage their investment portfolios.

As technology continues to evolve, AI and machine learning-driven stock forecasts are becoming increasingly sophisticated and accurate, providing investors with valuable insights to navigate the complex world of investing. By leveraging these advanced tools and staying informed, investors can better position themselves for success in the stock market.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005

Leave a Reply