Introduction

In today’s rapidly evolving global economy, it’s crucial to diversify your investments and explore opportunities in emerging markets. One such market, China, has consistently demonstrated remarkable growth over the past few decades. As the world’s second-largest economy, China is an attractive investment destination for those looking to benefit from its booming industries and innovative companies. By investing in the best Chinese stocks, you can tap into this economic powerhouse and potentially enjoy significant returns.

This article will serve as a comprehensive guide to the best Chinese stocks, providing insights into the top companies and ETFs to consider when expanding your portfolio. We will discuss the benefits of investing in these stocks and explore how leveraging AI stock forecasts and alternative financial data can help you make informed decisions. This guide aims to engage and inform readers at every stage of their investment journey. So, let’s dive in and explore the opportunities that await in the Chinese market!

Tencent Holdings Ltd. (OTC: TCEHY)

Tencent Holdings Ltd. (OTC: TCEHY), one of the largest technology companies in the world, is another top contender among Chinese stocks. Founded in 1998, Tencent has grown tremendously, now employing over 85,000 people with a market cap exceeding $500 billion. The company operates in various sectors, including social media, gaming, fintech, and cloud services, making it a well-diversified player in the market.

Tencent’s competitive advantages are numerous. Its popular social media platforms, such as WeChat and QQ, boast a massive user base, creating strong network effects that contribute to its dominance. Additionally, Tencent is a leading player in the gaming industry, with a vast portfolio of successful games and strategic investments in other gaming companies. The company also excels in fintech through its mobile payment platform, WeChat Pay, which has become one of the most widely used payment methods in China.

Investors should consider Tencent Holdings Ltd. for its robust growth potential, strong market position, and diversified revenue streams. The company’s ability to innovate and expand into new sectors makes it an attractive option for those looking to tap into the Chinese market.

TCEHY’s current trading price is 45.88 USD, with a year-to-date price increase of 2.92%. For more detailed information on Tencent’s future prospects, visit the TCEHY stock forecasts provided by FinBrain Technologies.

Alibaba Group Holding Ltd. (NYSE: BABA)

As one of China’s e-commerce giants, Alibaba has been a household name since its inception in 1999. With over 200,000 employees and a market cap of $263 billion, Alibaba has its hands in e-commerce, cloud computing, and digital media.

Alibaba’s competitive advantages include its dominant position as a leading e-commerce player in China, a diversified business portfolio that spans cloud computing, digital media, and financial services, and a strong network effect that attracts more users to its platforms.

Trading at $96.17 and showing a 4.56% YTD percent change, BABA has the potential to be a great addition to your portfolio. If you’re interested in learning more, check out the BABA stock forecasts on FinBrain. Alibaba is also one of the most popular Chinese stocks on the Internet’s largest online trading community WallStreetBets.

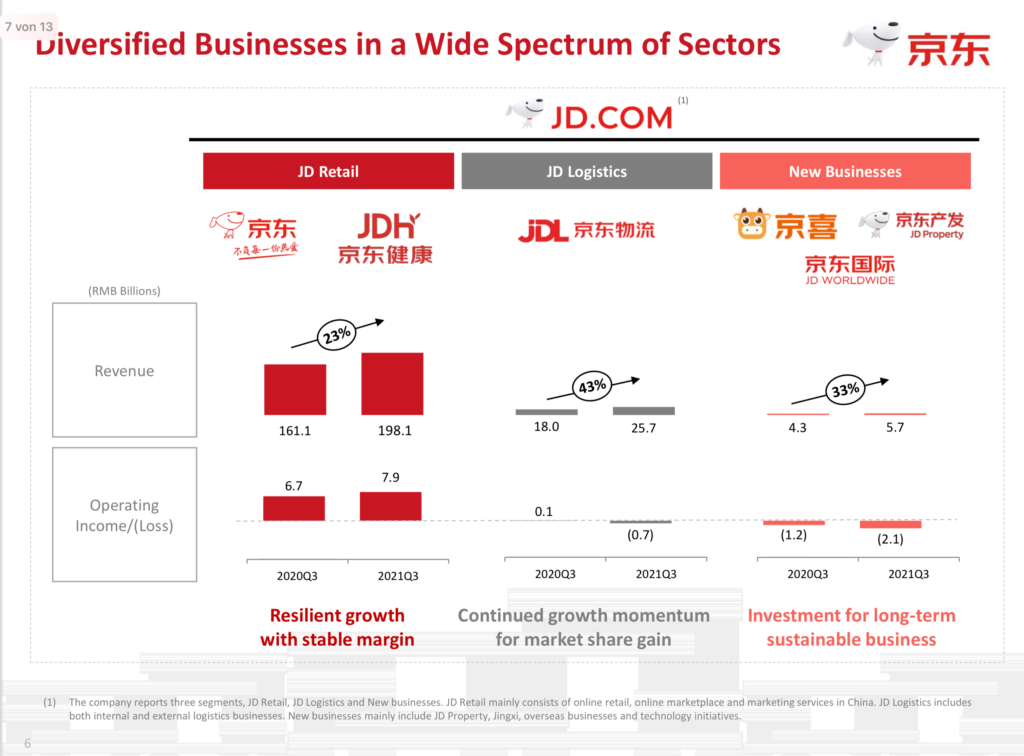

JD.com Inc. (NASDAQ: JD)

Another e-commerce heavyweight, JD.com has been thriving since 2004. With around 370,000 employees and a market cap of $57 billion, JD.com specializes in electronics and home appliances.

JD.com’s competitive edge lies in its extensive logistics network, proprietary technology, and focus on delivering high-quality products and exceptional customer service, setting it apart from other e-commerce competitors in China.

Although the stock is trading at $37.45 with a -35.03% YTD drop in stock price, it’s worth keeping an eye on. For more insights, visit JD stock forecasts on FinBrain.

NetEase Inc. (NASDAQ: NTES)

Founded in 1997, NetEase is a leading Chinese internet company focusing on gaming, e-commerce, and music streaming. With over 30,000 employees and a market cap of $62 billion, NTES is a solid choice for investors seeking exposure to China’s booming gaming industry.

NetEase stands out due to its strong presence in the online gaming industry, a robust portfolio of popular and profitable games, and its ability to expand into new markets and digital services like e-commerce and music streaming.

Trading at $90.06 with a 17.8% YTD percent change, you can explore more about NTES stock forecasts on FinBrain.

Baidu Inc. (NASDAQ: BIDU)

Baidu, founded in 2000, is China’s answer to Google. With over 40,000 employees and a market cap of $46 billion, Baidu offers search engine services, AI, and autonomous driving technology.

Baidu’s competitive advantages stem from its dominant position as China’s leading search engine, significant investments in AI and autonomous driving technology, and its push into new growth areas like cloud computing and smart devices.

BIDU is trading at $132.73 with an 11.42% YTD increase in its stock price. To dive deeper, check out BIDU stock forecasts on FinBrain.

You may also like to read our article about the Top publicly traded AI companies.

Nio Inc. (NYSE: NIO)

Nio is an electric vehicle (EV) manufacturer founded in 2014. With around 9,000 employees and a market cap of $14.6 billion, Nio is considered the “Tesla of China”.

Nio’s key strengths include its innovative electric vehicle (EV) designs, a strong brand presence in the premium EV segment, and a unique battery subscription model that sets it apart from other EV manufacturers. These make NIO one of the most attractive Chinese stocks for investors.

Currently trading at $9.10 with a -5.5% YTD percent change, NIO is worth monitoring for long-term growth potential. Discover more about NIO stock forecasts on FinBrain.

Bilibili Inc. (NASDAQ: BILI)

Bilibili, established in 2009, is a popular Chinese video-sharing platform specializing in animation, comics, and games. With over 8,000 employees and a market cap of $6 billion, BILI is a stock to watch for investors interested in China’s entertainment sector.

Bilibili differentiates itself through its unique content ecosystem that combines user-generated videos, live streaming, and mobile games, attracting a large and highly engaged user base, particularly among China’s younger generations.

Trading at $21.40 with a -20.74% YTD percent change, it’s a stock to keep on your radar. Find out more about BILI stock forecasts on FinBrain.

Trip.com Group Ltd. (NASDAQ: TCOM)

Trip.com, founded in 1999, is a leading Chinese online travel agency offering hotel bookings, flights, and vacation packages. Trip.com’s competitive advantages include its position as a leading online travel agency in China, a vast range of travel products and services, and a strong focus on technology and innovation to enhance the customer experience.

With over 45,000 employees and a market cap of $20 billion, TCOM is an excellent choice for investors looking to capitalize on the post-pandemic travel boom.

Trading at $35.73 with a 0.11% YTD percent change, you can learn more about TCOM stock forecasts on FinBrain.

Sohu.com Ltd. (NASDAQ: SOHU)

Sohu.com, established in 1996, is a pioneer in China’s internet industry, offering search engine services, online gaming, and digital advertising.

Sohu’s strengths lie in its diverse range of online products and services, including news, video streaming, and online gaming, as well as its ability to adapt to changing market trends and consumer preferences.

With roughly 8,000 employees and a market cap of $573 million, SOHU is currently trading at $14.11 with a -1.26% YTD percent change. To delve deeper, check out SOHU stock forecasts on FinBrain.

Li Auto Inc. (NASDAQ: LI)

Li Auto is another player in China’s booming EV market. Founded in 2015, it has approximately 4,000 employees and a market cap of $20 billion.

Li Auto sets itself apart through its focus on extended-range electric vehicles (EREVs), which combine the benefits of both electric and internal combustion engines, offering a unique value proposition for consumers in China’s competitive EV market.

Trading at $24.22 with a 15.44% YTD percent change, you can explore more about LI stock forecasts on FinBrain.

You may also like to read about the Top publicly traded EV stocks.

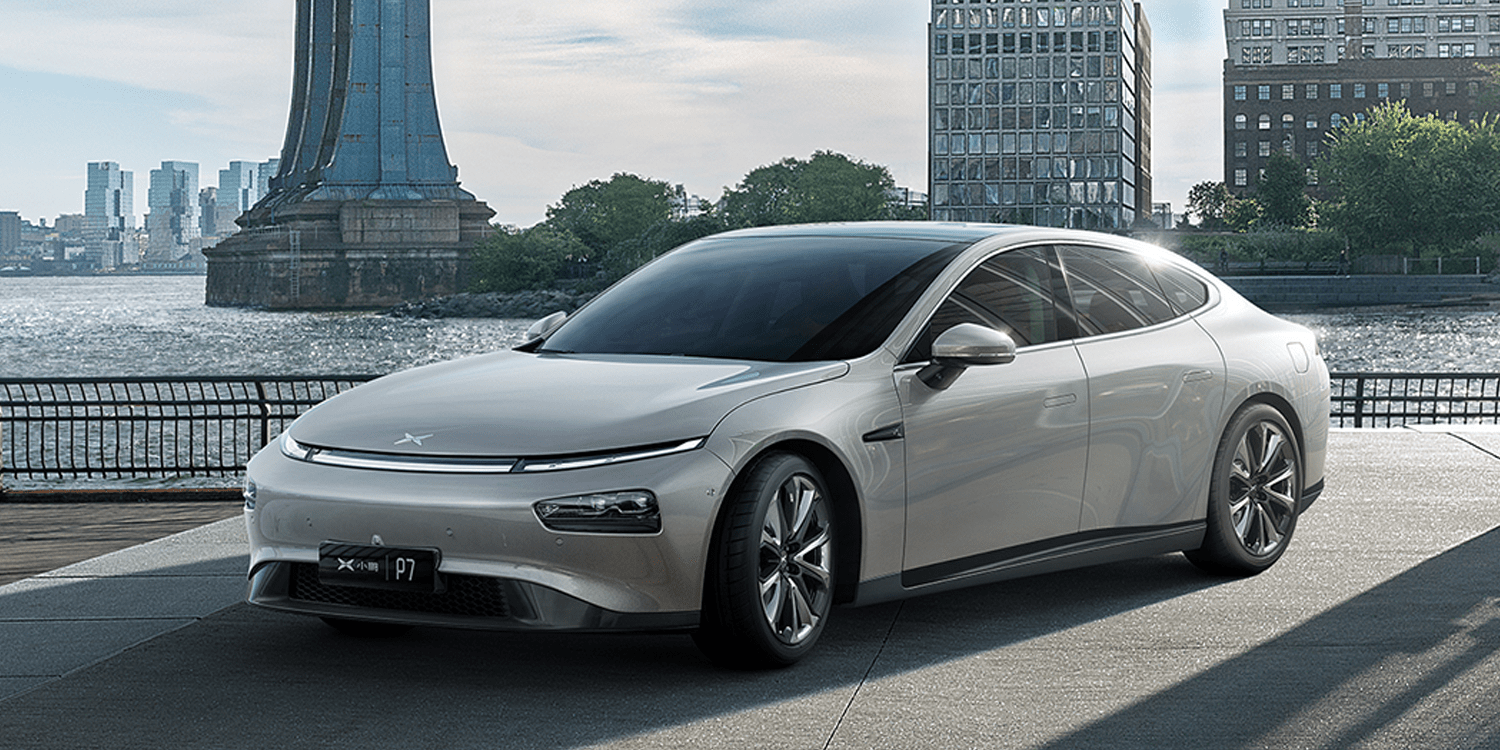

Xpeng Inc. (NYSE: XPEV)

Xpeng, founded in 2014, is an EV manufacturer targeting China’s growing middle class. With over 6,000 employees and a market cap of $7.8 billion, XPEV offers cutting-edge, affordable electric vehicles.

Xpeng’s competitive advantages include its innovative smart EV designs, strong investment in autonomous driving technology, and a commitment to offering affordable, high-quality EVs to the Chinese market.

Trading at $9.98 with a -1.96% YTD percent change, learn more about XPEV stock forecasts on FinBrain.

China-focused ETFs to Watch

In addition to individual Chinese stocks, consider these China-focused ETFs that offer diversified exposure to various sectors and industries within China’s economy. Here, we provide more details about each ETF to help you make an informed decision.

iShares China Large-Cap ETF (ETFs: FXI)

iShares China Large-Cap ETF, with the ticker FXI, seeks to track the investment results of the FTSE China 50 Index, which consists of the 50 largest Chinese companies listed on the Hong Kong Stock Exchange. These companies represent a range of sectors, including financials, energy, communication services, and consumer discretionary. FXI is trading at $29.07 with a -0.85% YTD percent change. With a total net asset value of around $4 billion and an expense ratio of 0.74%, FXI is a popular option for investors seeking exposure to China’s large-cap companies. For more insights, explore FXI price forecasts on FinBrain.

iShares MSCI China ETF (ETFs: MCHI)

iShares MSCI China ETF, with the ticker MCHI, aims to replicate the performance of the MSCI China Index. This index includes large- and mid-cap Chinese companies across various sectors, such as information technology, communication services, consumer discretionary, and financials. MCHI provides a more diversified exposure to China’s market compared to FXI, as it includes approximately 600 companies. Currently trading at $49.26 with a 0.31% YTD percent change, MCHI has a total net asset value of around $7 billion and an expense ratio of 0.59%. To learn more, visit MCHI price forecasts on FinBrain.

SPDR S&P China ETF (ETFs: GXC)

SPDR S&P China ETF, with the ticker GXC, seeks to track the performance of the S&P China BMI Index, which includes Chinese companies from all market capitalizations. This ETF provides a comprehensive exposure to China’s equity market, encompassing approximately 700 companies from various sectors, such as information technology, financials, consumer discretionary, and health care. GXC is trading at $81.85 with a 1.15% YTD percent change. With a total net asset value of around $1.3 billion and a relatively low expense ratio of 0.59%, GXC is an attractive option for investors looking for broad exposure to China’s stock market. Discover more about GXC price forecasts on FinBrain.

By investing in these China-focused ETFs, you can gain diversified exposure to the Chinese market, mitigating the risks associated with individual stocks. Each ETF offers different levels of diversification and exposure to various sectors, so make sure to choose the one that aligns with your investment strategy and risk tolerance.

FinBrain Technologies: AI Stock Forecasts and Alternative Financial Data

When investing in Chinese stocks or any market, using AI-assisted, data-driven investing can significantly increase your chances of success. FinBrain Technologies offers AI stock forecasts, news sentiment analysis, mobile app score ratings, US Congress Members’ trades, option put-call ratios, and much more.

In addition to the US-listed Chinese stocks discussed in this article, you can also access stock forecasts, news sentiment analysis, and mobile app score ratings for over 2000 stocks listed under the Hong Kong Hang Seng Index on FinBrain Terminal’s HK Hang Seng stock forecasts page.

By leveraging FinBrain’s AI stock forecasts and alternative data, individual investors can make better-informed decisions and maximize their investment returns. To access these valuable insights, check out the FinBrain Terminal, where traders and investors worldwide can utilize AI stock forecasts and alternative data in their investment strategies.

For institutional traders and data-driven funds, the FinBrain API provides access to a wealth of information that can be incorporated into investment strategies. FinBrain also offers a Most Mentioned Tickers on WallStreetBets tracker, keeping you informed about trending stocks.

Conclusion

Investing in the best Chinese stocks offers an opportunity for significant growth and diversification. By exploring the companies and ETFs mentioned in this guide and leveraging FinBrain Technologies’ AI stock forecasts and alternative data, you can make informed investment decisions with confidence. Remember, the key to successful investing is staying informed and using all available tools to optimize your strategy. Good luck, and happy investing!

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005

Leave a Reply