Introduction

Artificial Intelligence (AI) is rapidly transforming the way businesses operate and has become a key driver of growth in several industries. As such, companies that specialize in AI products and services have emerged as major players in the global economy. This has resulted in a growing interest among investors in AI focused publicly traded companies, with many seeking to tap into the potential growth opportunities presented by this sector.

C3.ai, Snowflake, Palantir, Docusign, Alteryx and Irhythm are among some of the most promising publicly traded companies that focus solely on developing, serving and scaling AI-centric products and services.

In this article, we will explore how a focus on AI can impact the share prices of these companies positively, examining the market trends, technological innovations, and competitive landscape that are shaping the future of the AI industry.

We will also explain how you can take advantage of AI and alternative data to predict the future prices of these companies and make better informed investment decisions.

Top AI stocks that are solely focusing on building AI solutions

C3.ai Inc (NYSE: AI)

Founded in 2009, C3.ai is a software company that develops enterprise-scale artificial intelligence applications for a range of industries, including energy, financial services, and manufacturing. Their platform utilizes machine learning algorithms and big data analytics to help organizations optimize business processes, reduce costs, and improve operational efficiency. The company went public in December 2020, and its stock has seen significant growth since then.

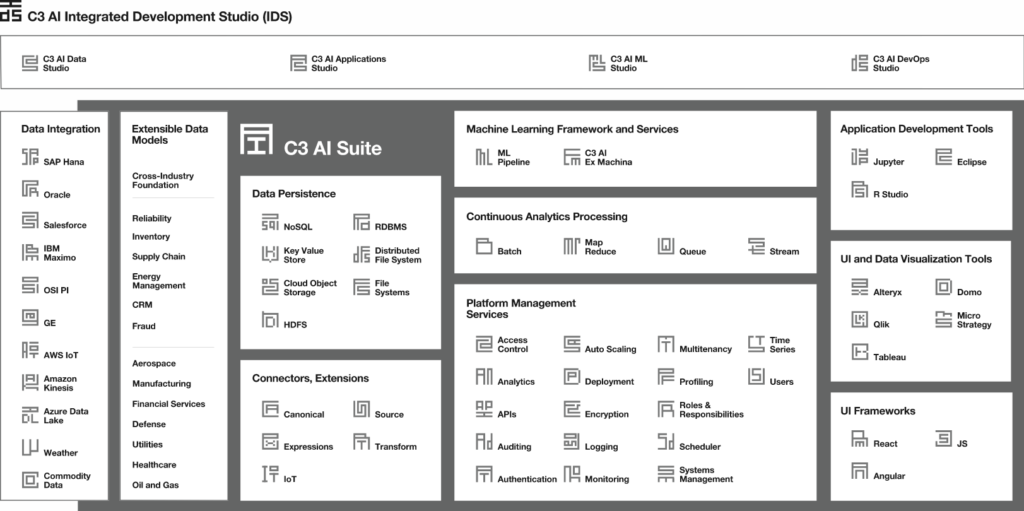

What is C3.ai’s core AI product?

C3 AI Suite is the company’s flagship product that provides an end-to-end platform for developing, deploying, and operating enterprise-scale AI applications. It includes a suite of pre-built AI applications, including C3 AI Predictive Maintenance, C3 AI Fraud Detection, and C3 AI Energy Management, as well as tools for developing custom AI applications.

How disruptive is C3.ai with its AI applications?

C3.ai’s platform is disruptive in that it provides organizations with an end-to-end platform for building and deploying enterprise-scale AI applications. By combining big data analytics with machine learning algorithms, C3.ai enables organizations to automate processes, identify patterns and anomalies, and make data-driven decisions in real time. This has the potential to disrupt a range of industries, from manufacturing and healthcare to energy and finance.

Snowflake Inc. (NYSE: SNOW)

Snowflake offers a cloud-based data warehousing and analytics platform that allows organizations to store, manage, and analyze large amounts of data in real-time. The platform is built on top of Amazon Web Services (AWS), Google Cloud, and Microsoft Azure, and offers advanced features such as automated scaling, data sharing, and multi-cloud support. Snowflake went public in September 2020 and has since seen significant growth in its stock price.

While Snowflake is not strictly an AI-focused company, their platform does offer advanced features for processing and analyzing large datasets that can be leveraged for AI use cases. Some of the core features of Snowflake’s platform include automated scaling, data sharing, and multi-cloud support.

Here is how Snowflake can keep disrupting many industries

Snowflake‘s platform is disruptive in that it provides organizations with a scalable, cloud-based solution for processing and analyzing large datasets. By eliminating the need for expensive on-premise infrastructure and providing automated scaling, Snowflake enables organizations to process data faster and more efficiently, and to take advantage of machine learning and AI technologies. This has the potential to disrupt industries ranging from finance and healthcare to retail and logistics.

Palantir Technologies Inc. (NYSE: PLTR)

Palantir is a software company that specializes in big data analytics and management. Their software is used by a range of clients, including government agencies, financial institutions, and healthcare organizations, to help them make better-informed decisions based on large datasets. Palantir’s software is known for its ability to handle complex, unstructured data and its powerful data visualization capabilities. The company went public in September 2020 and has since seen strong growth in its stock price.

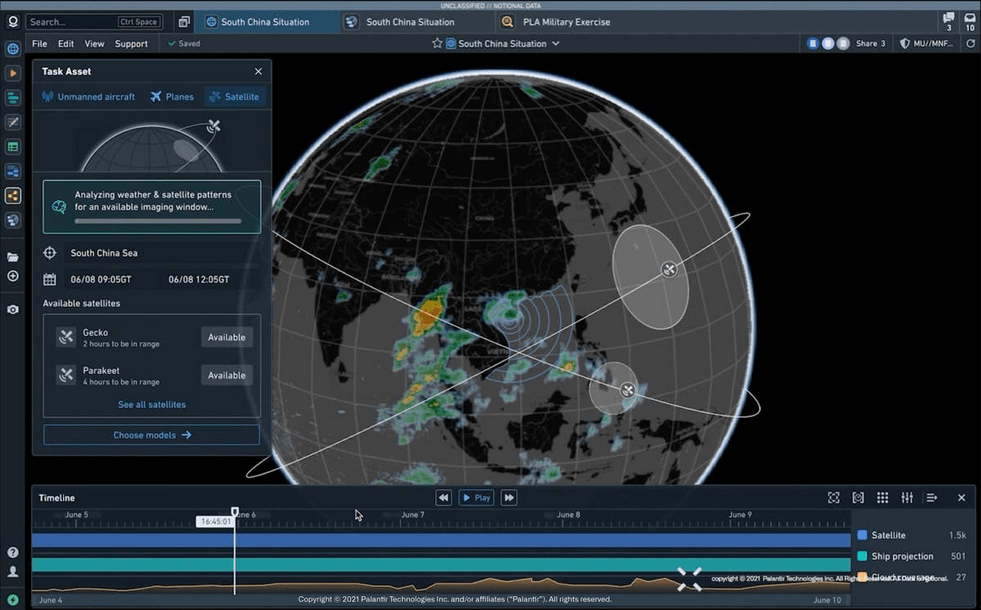

What is Palantir’s core AI and data product?

Palantir Gotham is the company’s core product that provides a data integration and analysis platform for government agencies, financial institutions, and other large organizations. It includes tools for data integration, data management, and data analysis, as well as advanced features such as real-time data processing and powerful data visualization capabilities.

How does Palantir help its clients to make data-driven decisions?

Palantir’s platform is disruptive in that it provides organizations with a powerful data integration and analysis solution that can handle large and complex datasets. Palantir‘s software has been used by government agencies and financial institutions to identify patterns and anomalies in large datasets, and to make data-driven decisions. This has the potential to disrupt a range of industries, including government, finance, and healthcare.

Docusign Inc. (NASDAQ: DOCU)

DocuSign is a digital signature and transaction management company that allows organizations to sign, send, and manage electronic documents securely. The platform is used by businesses of all sizes, including Fortune 500 companies, to automate document workflows and reduce manual processes. DocuSign’s software integrates with popular business applications such as Salesforce, Microsoft Office, and Google Docs. The company went public in April 2018 and has since seen strong growth in its stock price.

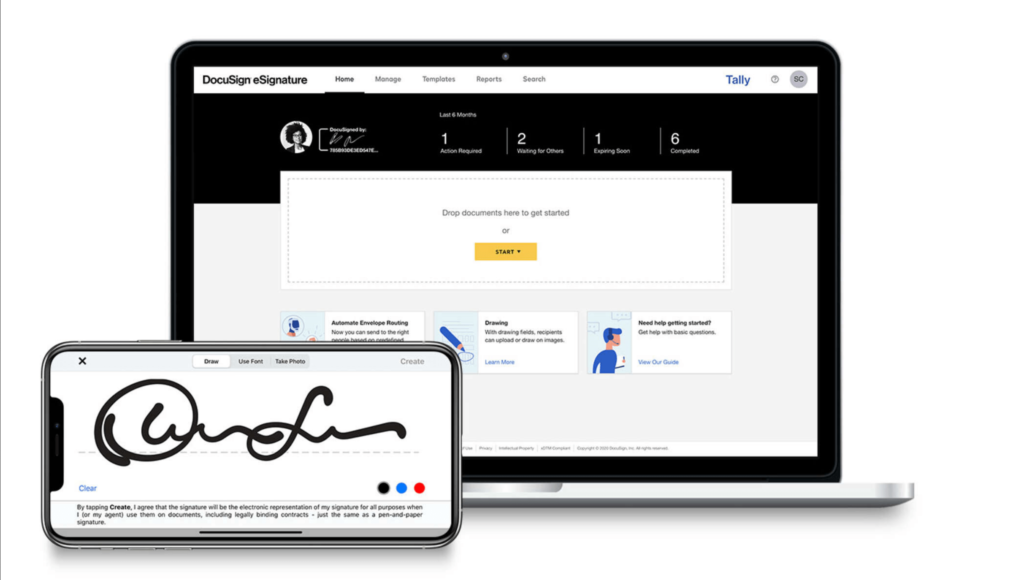

What is DocuSign’s flagship product?

DocuSign eSignature is the company’s core product that provides a digital signature and transaction management platform for businesses of all sizes. It includes tools for creating, sending, and signing electronic documents, as well as integrations with popular business applications such as Salesforce, Microsoft Office, and Google Docs.

How does eSignature disrupt a wide range of industries?

DocuSign‘s eSignature platform is disruptive in that it provides organizations with a faster and more efficient way to process and sign documents. By eliminating the need for physical signatures and manual document processing, DocuSign enables organizations to save time and reduce costs, while also improving the customer experience. This has the potential to disrupt a range of industries, from real estate and legal services to healthcare and government.

Alteryx Inc. (NYSE: AYX)

Alteryx is a software company that specializes in data preparation and analysis. Their platform allows users to access, prepare, and analyze data from a range of sources, including spreadsheets, databases, and cloud services. Alteryx’s software is used by a range of industries, including finance, healthcare, and retail, to help them make data-driven decisions. The company went public in March 2017 and has since seen strong growth in its stock price.

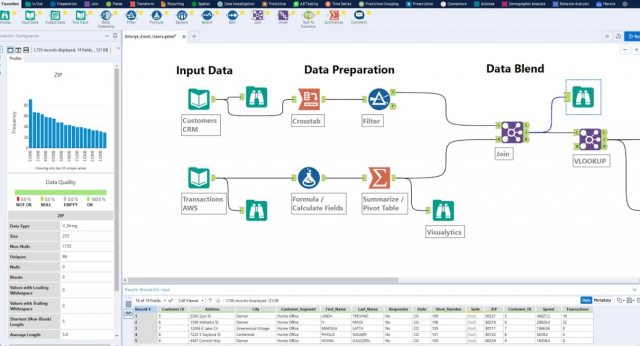

What is Alteryx’s core data product?

Alteryx Designer is the company’s core product that provides a platform for data preparation, blending, and analysis. It includes a range of tools for data cleansing, transformation, and analysis, as well as integrations with popular data sources such as Excel, Salesforce, and Hadoop.

How can Alteryx disrupt many industries with its data products?

Alteryx’s platform is disruptive in that it provides organizations with a more efficient way to prepare and analyze data. By eliminating the need for manual data preparation and blending, Alteryx enables organizations to process data faster and more accurately, and to take advantage of machine learning and AI technologies. This has the potential to disrupt a range of industries, including finance, healthcare, and retail.

Irhythm Technologies Inc. (NASDAQ: IRTC)

Irhythm is a medical device company that specializes in wearable biosensors and analysis software for remote cardiac monitoring.

Irhythm’s software is used by healthcare professionals to help diagnose and manage arrhythmias and other heart conditions. The company went public in October 2016 and has since seen strong growth in its stock price.

What’s Irhythm’s core product?

Their flagship product, the Zio monitor, is a small, adhesive patch that continuously records a patient’s heart rhythm for up to two weeks. The device can be worn during normal daily activities and provides physicians with a detailed report of the patient’s heart activity. This has the potential to disrupt the healthcare industry and improve patient outcomes.

How focusing on AI can affect the stock prices of these companies?

The impact of AI products on the stock prices of these companies will depend on several factors, including market demand for AI products and services, the quality and effectiveness of the AI products offered, and the competitive landscape.

In general, the potential for growth and revenue from AI products and services can have a positive impact on stock prices. If a company’s AI products and services are seen as innovative, effective, and in high demand, this can generate positive investor sentiment and drive up the company’s stock price. Additionally, if the company is able to capture a significant share of the AI market, this can lead to sustained revenue growth and further positive impact on stock prices.

On the other hand, if a company’s AI products and services fail to meet expectations, or if the company faces intense competition from other players in the market, this can have a negative impact on stock prices. Additionally, if the market for AI products and services fails to grow as expected, this could limit the potential for revenue growth and negatively impact the company’s stock price.

It’s important to note that stock prices can also be impacted by broader market trends, economic conditions, and other factors unrelated to the specific performance of the company’s AI products and services. As such, investors should always consider a range of factors when making investment decisions, including the performance of the broader market, the financial health of the company, and the competitive landscape in the industry.

Why should investors consider AI focused stocks for future growth potential?

Strong Market Growth Potential: The global AI market is expected to continue to grow at a rapid pace in the coming years, driven by increasing demand for AI products and services across various industries. This presents an opportunity for companies in the AI sector to grow their revenues and profits, potentially leading to higher stock prices.

Disruptive Potential: Companies with AI products and services have the potential to disrupt existing markets and create new ones, leading to significant revenue growth and potentially higher stock prices.

Innovation and Competitive Advantage: Companies with strong AI capabilities have a competitive advantage in the marketplace, as AI technology can help businesses automate processes, identify patterns and anomalies, and make data-driven decisions in real time. This can help companies improve efficiency, reduce costs, and improve customer experiences, potentially leading to higher revenues and profits.

Long-Term Investment: Investing in AI focused stocks can be seen as a long-term investment, as the full potential of AI technology is still being realized. This means that there may be significant growth potential over the coming years, making AI stocks a good option for investors who are willing to take a long-term view.

Diversification: Investing in AI focused stocks can provide diversification for investors’ portfolios, as the AI sector is still in the early stages of development and is not fully correlated with other sectors of the economy.

Investing in AI focused stocks can provide investors with exposure to a rapidly growing and innovative sector of the economy, potentially leading to significant growth potential over the long term.

How to predict the share prices of the top AI stocks using AI and Alternative Data

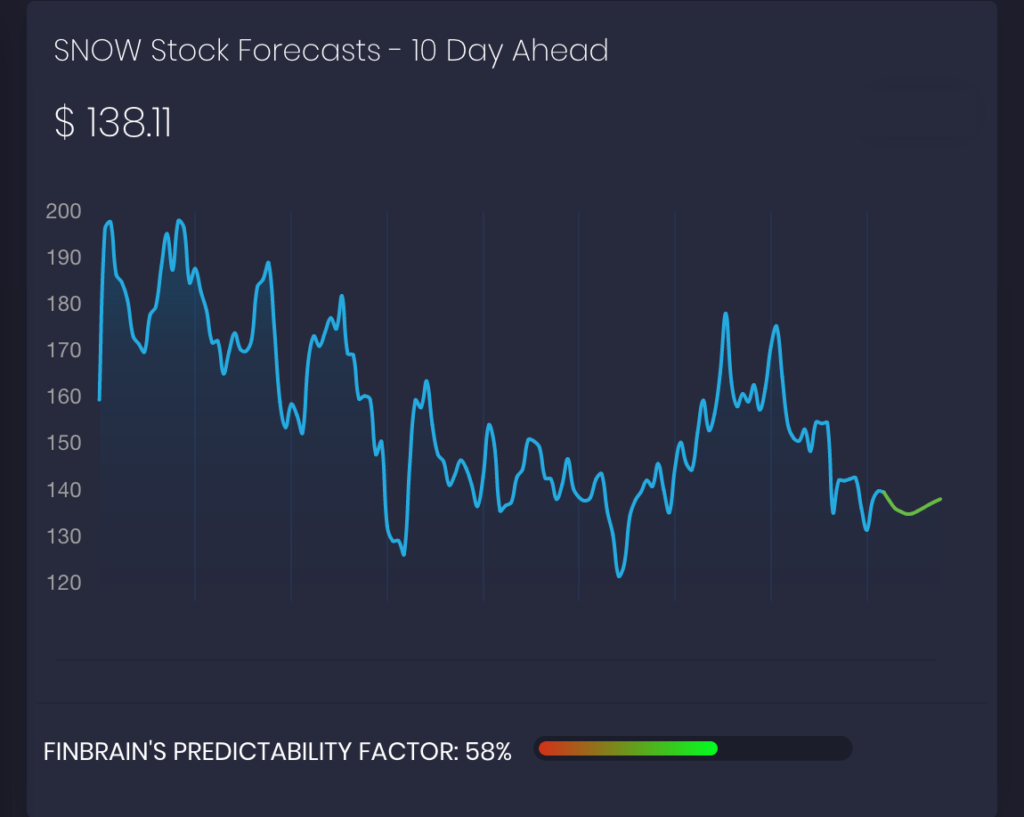

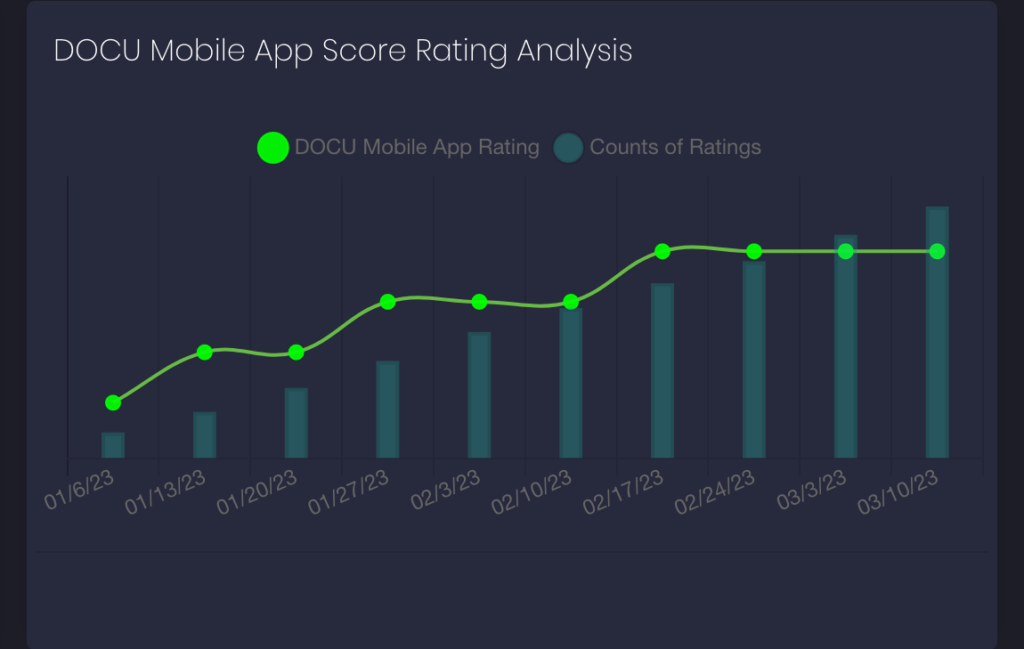

FinBrain Technologies has been the ultimate go-to place for the investors who would like to take advantage of the data and AI tools in their investment decisions. Our algorithms collect vast sums of traditional and alternative market data for more than 10.000 assets on a daily basis and our AI models are generating forecasts based on the data.

AI stock price predictions are proven to be useful for identifying trends and patterns in the markets. FinBrain has been developing and fine tuning complex models built on top of alternative datasets such as news sentiment scores, mobile app scores, options put-call ratios, company insider transactions, US congress members’ trades and much more.

Our models and datasets exhibit a remarkable accuracy when it comes to forecasting the future price movements of the assets. You can refer to our past performances blog to read more about how to take advantage of the data on FinBrain Terminal to make better informed investment decisions.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005

Leave a Reply